Table of Contents

A Region at a Crossroads, Powered by Consulting

The Middle East is undergoing one of the most ambitious transformations in its modern history. As governments push to diversify economies away from oil dependency and toward knowledge-based, innovation-driven futures, consulting firms have become central to this seismic shift. From sweeping national strategies like Saudi Arabia’s Vision 2030 to digital infrastructure investments across the UAE, consultants are not just advising change—they’re helping build it.

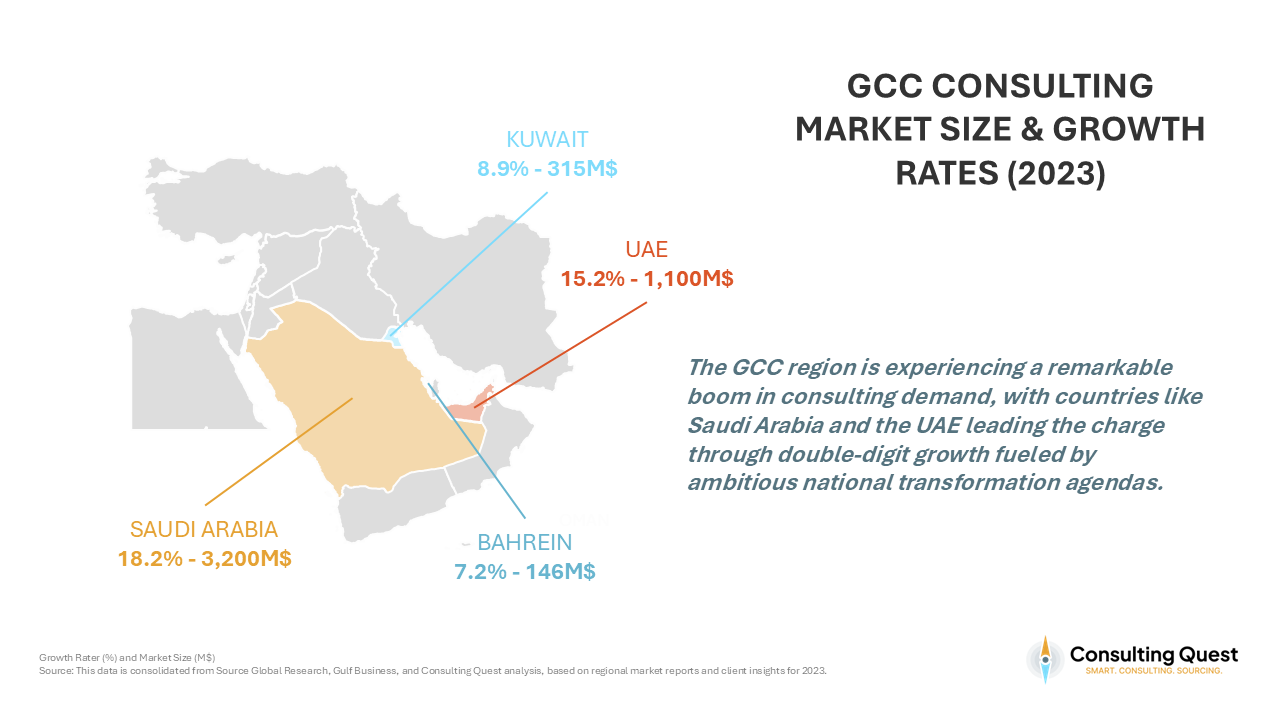

This is a market in motion. While global consulting markets flirt with contraction, the Gulf Cooperation Council (GCC) nations—Saudi Arabia, UAE, Qatar, and others—are experiencing a consulting boom, driven by high-stakes projects and accelerated reform agendas. In 2024, the region’s consulting market is poised to surpass the $6 billion threshold, with growth rates that outpace traditional Western economies.

But growth is just one part of the story. As the market evolves, so too do client expectations, firm strategies, and competitive dynamics. Legacy brands no longer dominate by default. Specialized boutiques are gaining ground. Regulatory complexity and cultural nuance demand a tailored, relationship-first approach. And buyers—public and private—are becoming more strategic in how they source consulting talent.

In this article, we’ll explore the changing consulting landscape in the Middle East, examining:

- Where the growth is coming from—and where it’s headed next

- How leading firms are adapting to the region’s unique business culture

- What clients should know before engaging consultants in this fast-moving environment

Whether you’re a multinational expanding into the Gulf, a public-sector leader planning the next megaproject, or a procurement professional seeking to optimize consulting spend, this guide will help you navigate the opportunities—and avoid the pitfalls—of consulting in the Middle East.

I. GCC Growth Engines

The Gulf Cooperation Council (GCC) is at the heart of the Middle East’s consulting renaissance. Comprising Saudi Arabia, the United Arab Emirates, Qatar, Kuwait, Bahrain, and Oman, this bloc is rapidly emerging as a consulting hotspot—fueled by visionary national plans, megaprojects, and an appetite for global best practices. Let’s break down the consulting dynamics in each key market.

A. Saudi Arabia: Vision 2030 and a $3.2 Billion Consulting Surge

Saudi Arabia is the undisputed giant of the region’s consulting landscape. In 2023, the market grew an astonishing 18.2%, reaching $3.2 billion. At the core of this expansion is Vision 2030, the Kingdom’s sweeping national transformation plan. From the $500 billion NEOM mega-city to wide-scale privatization and public sector reform, consulting firms are deeply embedded in the blueprinting, implementation, and oversight of these initiatives.

Top global firms—alongside agile boutiques—are capitalizing on the demand for strategic planning, infrastructure development, change management, and digital transformation. Notably, the public sector remains a dominant buyer, requiring not just technical expertise but also cultural alignment and trust-based relationships.

B. United Arab Emirates: Diversification and Innovation Drive Demand

The UAE consulting market grew by 15.2% last year, now valued at $1.1 billion. Dubai and Abu Dhabi lead the charge, leveraging their global connectivity and economic openness to attract both multinational clients and world-class consulting talent.

Consulting demand is strongest in tourism, finance, healthcare, and real estate, where strategic investments and regulatory innovation are reshaping industries. Moreover, the UAE’s push toward AI integration and smart governance fuels significant opportunities in technology advisory, digital strategy, and public-private collaboration. Firms that combine regional fluency with technical depth are especially well-positioned.

C. Kuwait: A Steady Climb Anchored in Infrastructure

Kuwait’s consulting market, while smaller, is growing steadily—8.9% in 2023, totaling $315 million. The country’s National Development Plan (New Kuwait 2035) drives demand across infrastructure, education, healthcare, and oil and gas.

Unlike its neighbors, Kuwait’s consulting procurement remains relatively conservative, but shifts are underway. There’s rising interest in public sector modernization, digital government, and sustainability, creating space for firms with capabilities in engineering, process design, and ESG strategy.

D. Qatar: Post-World Cup Correction, Long-Term Vision

Following the 2022 FIFA World Cup, Qatar’s consulting market corrected downward by 9.8%, settling at $445 million. This recalibration was expected after years of pre-event investment. However, the country remains strategically committed to Qatar National Vision 2030, with ongoing initiatives in education, transport, healthcare, and economic diversification.

Consulting firms active in Doha are focusing on helping government entities transition from execution mode to long-term optimization and value capture—especially in areas like sustainability, economic policy, and infrastructure lifecycle management.

E. Bahrain and Oman: Cautious Optimism

Bahrain saw a 7.2% uptick, reaching $146 million in consulting spend. The government’s Economic Vision 2030 and a strong financial sector continue to generate demand for services in banking transformation, logistics, and regulatory compliance.

Oman, by contrast, experienced a slight contraction. While projects aligned with Oman Vision 2040 continue—especially in tourism and logistics—macroeconomic pressures have constrained large-scale consulting investment. Nonetheless, Oman remains an important market for firms skilled in cost optimization, capability building, and public sector efficiency.

II. Broader Middle East and North Africa (MENA) Dynamics

While the GCC dominates headlines, the broader MENA region presents a tapestry of consulting opportunities shaped by geography, politics, and economic ambition. Countries like Egypt and Turkey serve as regional anchors, while others like Iran and Lebanon present niche but strategic plays. Let’s explore the consulting landscape beyond the Gulf.

A. Turkey: A Regional Anchor with Cross-Border Pull

Positioned at the crossroads of Europe and Asia, Turkey boasts a mature and diversified consulting market. With strong demand in financial services, energy, infrastructure, and manufacturing, Turkey serves not only as a domestic hub but also as a launchpad for regional projects reaching into Central Asia and Eastern Europe.

Consulting firms active in Turkey are leveraging local talent and industry know-how to advise on cross-border expansion, regulatory compliance, and economic policy. While inflation and political uncertainties persist, Turkey’s deep business ecosystem makes it a strategic node for regional consulting growth.

B. Egypt: Cairo Rising as North Africa’s Consulting Capital

Egypt’s consulting market is on a growth trajectory, fueled by megaprojects like the Suez Canal expansion, a new administrative capital, and broad investments in infrastructure and energy. In recent years, Cairo has emerged as a focal point for consulting activity in North Africa.

Opportunities abound in urban planning, project management, financial advisory, and public-private partnerships. Multinational firms and specialized boutiques alike are expanding their presence to support Egypt’s ambitious modernization efforts. Government demand is high, especially in initiatives related to digital transformation, governance, and public sector efficiency.

C. Iran: A Localized Market with Global Potential

Despite being largely isolated due to international sanctions, Iran’s consulting market is developing in niche areas—primarily oil, gas, banking, and manufacturing. Local firms dominate, offering advisory services tailored to the domestic economic environment.

Should geopolitical conditions change, the lifting of sanctions could open a floodgate of consulting demand. Global firms are watching closely, anticipating future openings to provide services in regulatory compliance, foreign investment strategy, and sectoral restructuring.

D. Lebanon: Resilience Amid Turmoil

Lebanon’s political and economic instability has weighed on the market, but Beirut remains a consulting hub, particularly for financial services and digital innovation. Lebanese firms and professionals are well-regarded across the Arab world, often serving regional mandates from Beirut or through diaspora networks.

While the domestic consulting market is constrained, there’s ongoing demand for services in banking transformation, governance advisory, and capacity building for NGOs and international agencies.

E. Jordan: Steady Growth in a Stable Climate

Jordan may be a small market, but it punches above its weight. With a stable political environment and a growing emphasis on education, healthcare, and digital services, Amman is seeing consistent consulting activity. The government is focused on reforms and development programs supported by international partners, opening space for firms with expertise in policy design, organizational development, and sector-specific modernization.

Great! Let’s move ahead with Section 3: Market Trends and Shifts. Here’s the draft for your review:

III. Market Trends and Shifts

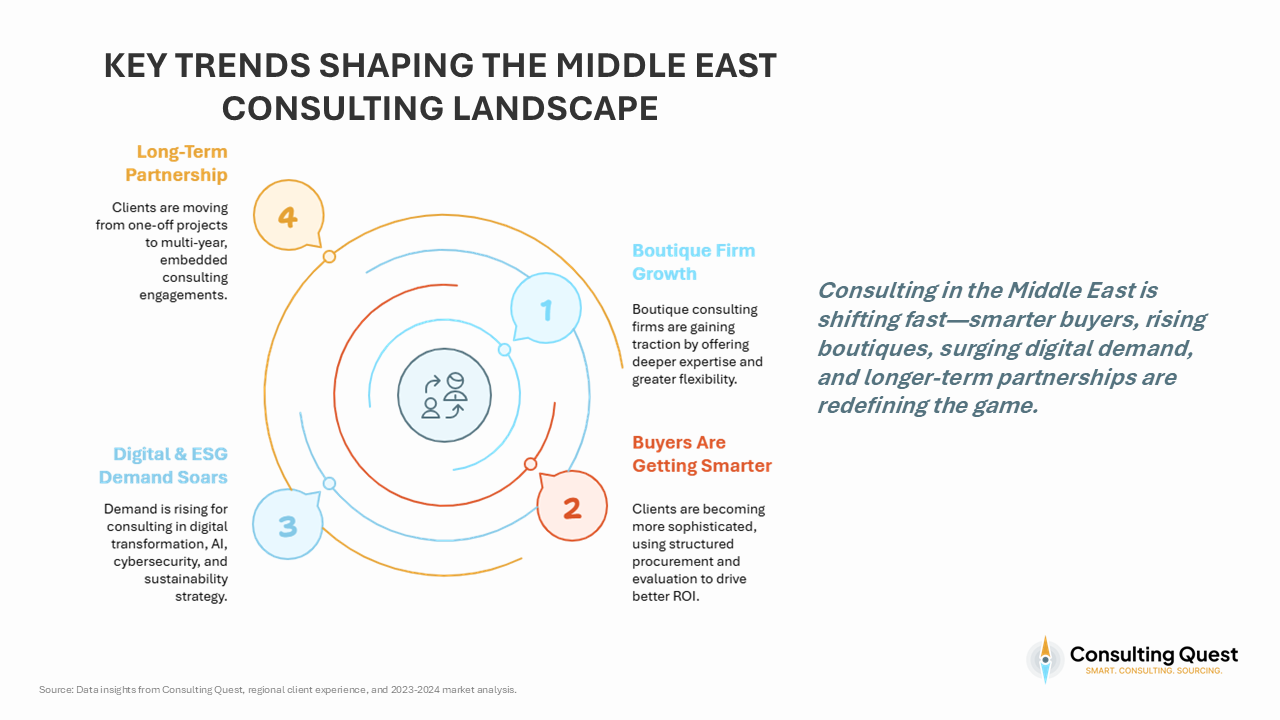

As the Middle East consulting market matures, the landscape is undergoing significant shifts—not just in who is buying consulting services, but also in who is delivering them and how. These trends are reshaping the competitive dynamics and redefining what clients value most in their consulting partners.

A. From Global Giants to Agile Specialists

Historically, large-scale projects in the Middle East—particularly in the public sector—were dominated by brand-name consulting firms. Their global reputation, government connections, and broad capabilities made them the default choice. Today, that dominance is no longer guaranteed.

Clients are increasingly turning to specialist and boutique consulting firms for their depth of expertise, flexibility, and cost-effectiveness. These smaller players often provide more customized, hands-on service and are willing to co-create solutions rather than deliver off-the-shelf frameworks. In markets like Saudi Arabia and the UAE, even ministries are diversifying their consultant portfolios, balancing prestige with performance.

B. Buyers Are Getting Smarter and More Strategic

Consulting buyers in the region—especially in the public sector—are beginning to recognize the need for more structured and strategic approaches to sourcing. While many organizations still rely on legacy relationships or informal selection criteria, there is growing awareness of the value that a more professionalized approach can bring.

Procurement functions, in particular, are starting to build up their capabilities in consulting sourcing. This includes learning how to define project scope more clearly, compare proposals meaningfully, and lay the foundation for performance tracking. Although still emerging, procurement-led consulting sourcing is gaining ground, especially in larger organizations seeking to improve transparency and return on investment.

This shift is putting consultants under greater scrutiny—not yet widespread, but enough to encourage more competitive and outcome-focused proposals. It’s a slow but important evolution in the way consulting engagements are initiated and managed across the region.

C. Digitalization and Sustainability Take Center Stage

Digital transformation remains a central theme across the region, with governments and corporations alike investing in AI, smart infrastructure, and digital governance. Consulting firms with strong capabilities in technology implementation, data analytics, and cybersecurity are in high demand.

At the same time, ESG and sustainability consulting is gaining traction. Countries like Egypt, Qatar, and Saudi Arabia are embedding sustainability into their economic visions, prompting demand for expertise in green finance, renewable energy policy, and climate risk assessment. Firms that can blend sustainability with strategy and execution are gaining an edge.

D. Consulting Is No Longer a One-Off Game

There’s a cultural shift underway—from viewing consultants as one-time advisors to seeing them as long-term transformation partners. This is particularly evident in large-scale national initiatives, where the lifecycle of a project may stretch across a decade.

Clients are seeking more than advice—they want implementation support, change management expertise, and capability building. As a result, we’re seeing more long-term contracts, embedded consulting teams, and hybrid delivery models that blend external and internal resources.

IV. Challenges in the Middle East Consulting Market

While the Middle East offers tremendous consulting opportunities, it’s far from a frictionless market. Success here requires more than just expertise—it demands cultural fluency, strategic patience, and operational adaptability. Let’s unpack the key challenges consulting firms and clients face in this evolving region.

A. Navigating Complex and Fragmented Regulations

Each country in the Middle East has its own regulatory ecosystem, making cross-border consulting engagements particularly complex. Firms must navigate:

- Licensing requirements that vary widely by jurisdiction

- Labor laws that affect local hiring and staffing models

- Data protection rules, which are tightening across the GCC

For clients, this complexity can slow down project kickoff, raise costs, and require additional legal diligence. For consulting firms, it demands localized expertise and often, partnerships with on-the-ground players to operate compliantly.

B. Cross-Border Costs and Operational Hurdles

Many consulting firms based in Europe or the US face high operating costs when delivering projects in the Middle East. These include:

- Visa processing and travel expenses

- Import duties on equipment or tech platforms

- Additional insurance and compliance overhead

These hidden costs can significantly inflate project budgets. Clients must be aware of them during negotiation, while firms must build lean delivery models to stay competitive.

C. The Relationship-Driven Nature of Business

In the Middle East, relationships often matter more than credentials. Trust, loyalty, and personal connection are at the heart of successful consulting engagements. This dynamic can challenge firms unfamiliar with the region’s cultural nuances.

To build trust, consultants must:

- Invest time in face-to-face interactions

- Understand local customs and decision-making hierarchies

- Show long-term commitment beyond the current project

Ignoring these factors can lead to misalignment, disengagement, or even losing the deal altogether.

D. Institutionalizing the Relationship to Avoid Dependency

While personal rapport is key, over-reliance on individual relationships can backfire. A consulting relationship anchored in just one executive sponsor becomes fragile when that person leaves or shifts roles.

Clients should work to institutionalize relationships by:

- Involving procurement early in the engagement process

- Ensuring multi-level alignment between both organizations

- Building shared governance structures that outlive individuals

This approach safeguards continuity and enhances value over the long haul.

V. Smart Strategies for Buyers

Successfully engaging consultants in the Middle East requires more than selecting the biggest name or the lowest bidder. With a complex business environment and rising expectations, buyers must take a strategic approach to maximize value. Here’s how to get it right from the start.

A. Be Clear on Your Needs and Goals

Start by defining what success looks like. Whether you’re launching a transformation program, digitizing operations, or entering a new market, clarity around the project’s objectives and scope will:

- Attract the right consulting partners

- Streamline proposal evaluation

- Set the foundation for measurable outcomes

Avoid generic RFPs. Instead, tailor your brief to reflect your strategic context, internal capabilities, and desired impact.

B. Navigate Pricing Strategically

Consulting fees in the Middle East can vary widely—especially when foreign firms are involved. Add in travel, accommodation, and cross-border operational costs, and the final invoice can exceed expectations.

Smart buyers should:

- Use pricing benchmarks from other regions or past projects

- Discuss rate cards and expenses upfront

- Model scenarios based on local vs. international delivery

- Account for regulatory or currency shifts in long-term contracts

The goal isn’t just to lower cost—but to align price with value.

C. Anchor the Relationship Beyond Individuals

In a relationship-driven market, strong personal connections matter—but don’t let them be the only foundation. If your consulting relationship hinges on one executive sponsor, the entire engagement becomes fragile.

To safeguard value:

- Involve procurement and finance in early-stage discussions

- Create multi-level alignment between your team and the firm

- Use joint steering committees or governance structures

This builds organizational resilience and continuity, especially in long-term projects.

D. Foster Long-Term Collaboration

Don’t treat every project as a one-off engagement. The most successful companies in the region view consultants as partners in transformation, not just external vendors.

Build loyalty and continuity by:

- Offering multi-phase project roadmaps

- Sharing visibility on long-term strategic goals

- Inviting consultants to co-develop solutions with your internal teams

This collaborative model improves accountability, accelerates knowledge transfer, and enhances results.

VI. Who’s Who – Top Consulting Firms in the Middle East

As the Middle East accelerates its economic diversification efforts, consulting firms have become indispensable partners in reshaping public institutions, enabling digital transformation, and driving private sector growth. Today, a wide range of players—from global giants to specialized boutiques—compete across the region to support this transformation.

Here’s a guide to the major types of consulting firms operating in the Middle East and what sets them apart.

A. Global Generalists

| Firm Name | Specialization | Strengths in Middle East |

| McKinsey & Company | Strategy, operations, digital transformation | Deep presence in GCC; strong in government and energy sectors |

| Boston Consulting Group (BCG) | Innovation, sustainability, digital | Active in UAE, KSA; supports large-scale transformation programs |

| Bain & Company | Private equity, growth strategy, performance | Known for efficiency-focused projects in private sector |

| Kearney | Operations, procurement, supply chain | Longstanding regional offices; strong in industrial and logistics |

| Oliver Wyman | Financial services, risk management, strategy | Strong presence in GCC financial hubs like Dubai and Riyadh |

| L.E.K. Consulting | M&A, healthcare, consumer goods | Growing visibility in MENA projects |

| Roland Berger | Digital strategy, innovation | Focused on tech and automotive sectors |

| Arthur D. Little | Innovation, telecom, R&D | Early mover in regional consulting; telecoms and infrastructure |

B. Specialist Players

| Firm Name | Specialization | Strengths in Middle East |

| AlixPartners | Turnaround, restructuring | Crisis management and restructuring in oil & gas sectors |

| FTI Consulting | Forensic, litigation, strategic communications | Involved in regulatory and legal advisory |

| Simon-Kucher & Partners | Pricing, sales, marketing | Notable work with regional retail and telecoms |

| Redseer Strategy Consultants | Digital economy, emerging markets | Very active in e-commerce, tech, and Saudi growth initiatives |

| Strategic Gears | Strategy, performance improvement | Local firm with strong Saudi government ties |

| OC&C Strategy Consultants | Retail, media, consumer goods | Focused retail strategy expertise in UAE and KSA |

| Mars & Co. | Tailored strategic consulting | Boutique presence; project-based strength |

| PMP Strategy | Market strategy, regulatory navigation | Local insights in Middle Eastern regulation |

C. Hybrid Firms (Consulting + IT/Professional Services)

| Firm Name | Specialization | Strengths in Middle East |

| Accenture | Technology, transformation | Major GCC presence, particularly in UAE smart city initiatives |

| PwC | Strategy, tax, assurance | Integrated consulting + audit services for regional clients |

| Deloitte | Technology, transformation, audit | Deep in public and private digital transformation projects |

| EY | Assurance, tax, advisory | Strong footprint in Saudi Vision 2030 delivery |

| KPMG | Risk, advisory, audit | Local compliance and transformation services |

| Capgemini | IT consulting, systems integration | Active in smart infrastructure and digital banking |

| NTT Ltd. | Tech innovation, infrastructure | Projects in telco and cloud implementation |

| Cognizant | IT services, digital modernization | Engaged in tech migration in oil & gas and healthcare |

A Market in Motion—And a Strategic Moment

The Middle East consulting market isn’t just growing—it’s transforming. As governments roll out bold national agendas and companies rethink their competitive edge, consulting firms have become critical allies in shaping the future. But navigating this market demands nuance, foresight, and a deep understanding of the region’s complexities.

Buyers now have more choices, more data, and more pressure to deliver results. Whether you’re managing a multi-billion-dollar megaproject in Saudi Arabia or rolling out a sustainability initiative in Egypt, the success of your consulting engagement hinges on clarity, cultural fluency, and strong procurement practices.

By aligning your consulting strategy with the realities of this dynamic region—clear goals, fair pricing, institutional relationships, and long-term thinking—you not only reduce risk but unlock real, sustained value.

🚀 Ready to Elevate Your Consulting Strategy?

At Consulting Quest, we help organizations like yours design smart sourcing strategies, build effective RFPs, and create value-driven consulting partnerships across the globe—including in the Middle East.

Book a free consultation call with our team and discover how we can help you succeed in one of the world’s most exciting consulting markets.