Índice

When organizations reflect on the outcomes of their consulting projects, it’s not uncommon to find a disconnect between the investment made and the value captured. Often, that gap stems from a narrow definition of success—one that prioritizes cost savings over real impact.

In many companies, especially those with decentralized decision-making or immature consulting governance, consulting sourcing is treated as a transactional exercise. The focus tends to gravitate toward price negotiations, contract terms, and keeping spend within budget. While these are important, they barely scratch the surface of the true value drivers.

Consulting is not a commodity. It’s a strategic lever. The impact of a consulting engagement depends on how well the problem is scoped, whether the right expertise is engaged, how the project is governed, and how outcomes are measured and translated into action. Saving 10% on fees won’t rescue a project that was poorly framed or mismanaged—or one that tackled the wrong challenge altogether.

To maximize consulting value, companies must move beyond savings alone and adopt a more holistic view of the sourcing process. That means understanding which steps create savings, which generate cost avoidance, and—most critically—which drive real impact and transformation.

In this article, we break down each phase of the consulting sourcing journey and analyze the role it plays in the value creation equation. From early-stage scoping to consultant selection, from negotiation to project execution and measurement, we’ll help you pinpoint where your efforts should go if your goal is not just to spend wisely—but to unlock the full potential of consulting.

1. The Dual Lens of Procurement Performance

When procurement leaders talk about performance, the conversation often starts—and ends—with savings. Metrics such as cost reduction, spend under management, and cycle time dominate dashboards and quarterly reviews. But when it comes to consulting, these traditional indicators only tell half the story.

The most mature procurement organizations have learned to look at performance through a dual lens: efficiency e effectiveness.

Efficiency: Are We Doing Things Right?

Efficiency is about process. It’s the operational backbone of procurement. In the context of consulting, it includes questions like:

- Are we sourcing projects quickly and competitively?

- Are we using technology to manage the process and reduce friction?

- Are we applying the right level of rigor to every project?

- Are we leveraging frameworks, templates, and past performance data?

Efficiency measures how well procurement runs—from cycle times to staff productivity and transaction costs. For consulting specifically, it might include metrics like average time to contract, consultant onboarding speed, or number of projects managed per FTE. But while these indicators matter, they don’t speak to what the consulting actually delivered.

And that’s where effectiveness comes in.

Effectiveness: Are We Doing the Right Things?

Effectiveness shifts the focus from operations to outcomes. It’s about value—whether the consulting work achieved its intended goals, enabled change, or unlocked new opportunities.

In consulting procurement, effectiveness can be measured by:

- The quality and impact of the recommendations delivered.

- The degree to which outcomes aligned with business objectives.

- Return on investment over time—especially when consulting enables transformation.

- Internal stakeholder satisfaction and adoption of consultant output.

This lens forces organizations to ask deeper questions: Are we launching the right projects? Are we working with the right consultants? Are we getting results that justify the investment?

Organizations that ignore this second dimension may appear efficient while still wasting significant value—by sourcing irrelevant work, partnering with underperforming consultants, or focusing on low-priority initiatives.

The Real Performance Equation

Kate Hart de CIPS Austrália captures this duality well, identifying five attributes that drive procurement performance: spend visibility, process efficiency, talent management, supplier performance, e strategic alignment. All of these, notably, live at the intersection of efficiency and effectiveness.

This is especially relevant in consulting, where each engagement is high-stakes, time-sensitive, and often politically charged. The procurement function isn’t just a gatekeeper or cost controller—it’s a value enabler. And its performance should reflect that.

Why This Matters for Consulting

Consulting projects often lack the clear benchmarks that govern more traditional categories. You can’t track price per unit or warranty claims. You’re assessing thinking, transformation, and change. And that means the way we measure performance has to evolve.

Increasingly, procurement leaders are embracing a more sophisticated model—one that considers both:

- Savings: The delta between what was paid and what could have been paid.

- Cost to Savings Ratio: The effort and expense involved in securing those savings.

- Value Creation: The strategic opportunities enabled by consulting—such as entering a new market, redesigning an organization, or accelerating a transformation.

In this view, procurement is not just about “spending less”—it’s about “enabling more.” And that makes all the difference.

2. Six Sourcing Steps That Drive Consulting Value

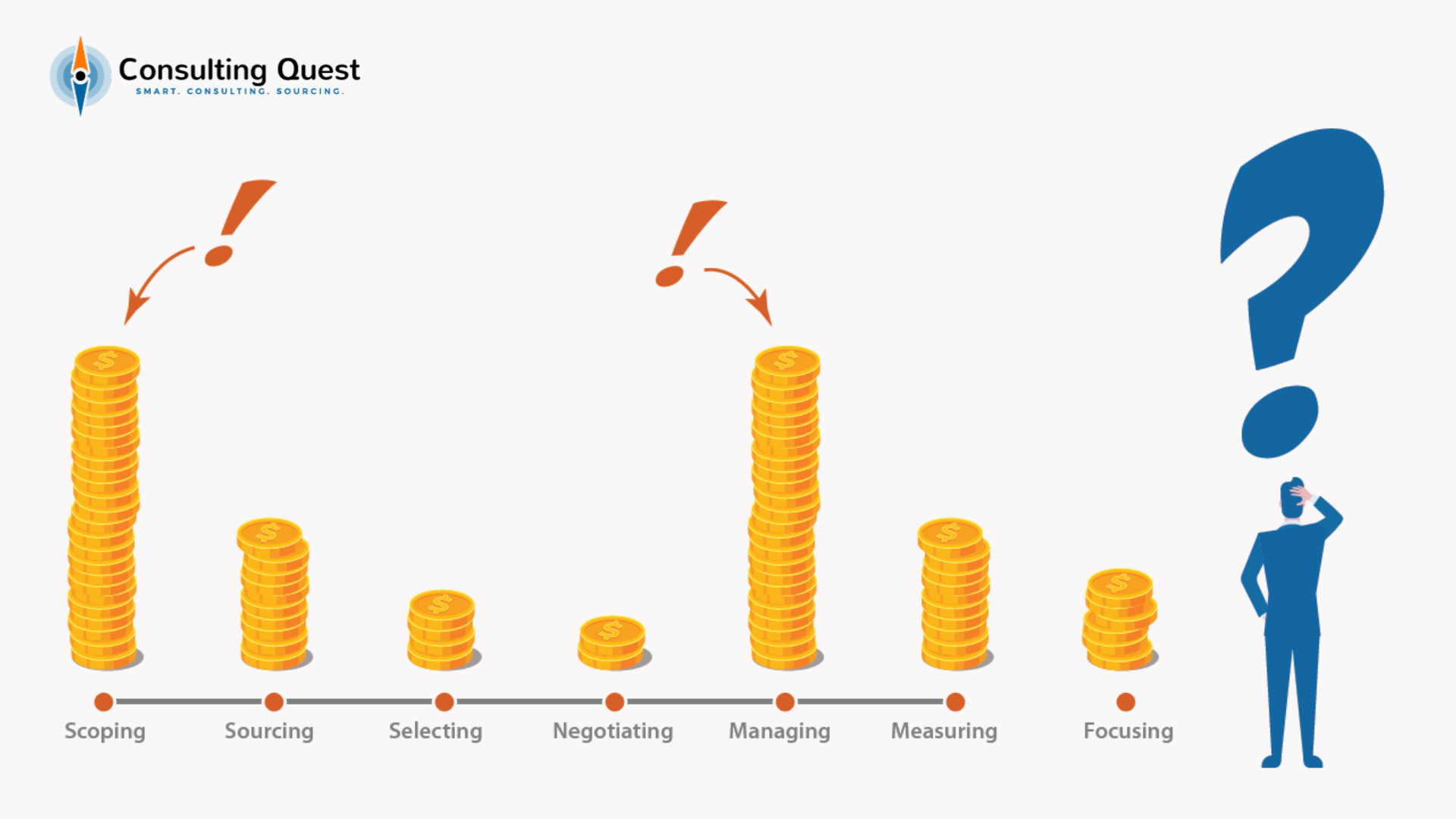

Not all steps in the consulting sourcing process contribute equally to value creation. Some steps are designed to reduce costs or avoid unnecessary spending, while others are pivotal for maximizing the impact of the consulting engagement itself.

Let’s explore each of the six steps—starting with the one that has the greatest leverage, and is most often underestimated: Escopo.

2.1 Scoping: The Critical First Move

If you only get one thing right in a consulting project, let it be this: the scope.

Scoping is not just a technical requirement for your RFP. It is the moment you define the problem you’re trying to solve, the outcomes you expect, and the role consulting should play in achieving them. It is, quite literally, where value begins—or where it gets lost.

Why Scoping Drives Cost Avoidance

The most immediate lever tied to scoping is cost avoidance. Scope the wrong problem, and you waste budget on solving an irrelevant issue. Scope the challenge too broadly, and you overpay for unused services or assign work to consultants that would have been better handled internally or by other providers.

Poor scoping decisions can inflate project costs by 50–100%. But more importantly, they create opportunity costs: when consulting resources are misallocated, the real, value-generating projects go unfunded—or unaddressed altogether.

The Value Multiplier Hidden in Clarity

Beyond avoiding waste, a well-scoped project unlocks significantly more impact. When expectations are clear and tightly aligned with business priorities, consultants can focus their expertise, tailor their recommendations, and move faster toward actionable outcomes.

Great scoping also allows for modular sourcing strategies. Consider this example:

You’re planning a major acquisition and want to outsource the full process—from screening targets to integration. The instinct may be to issue one large RFP to a strategy firm. But by breaking the project into phases, you can:

- Use a boutique for the initial market screening.

- Handle the internal due diligence in-house.

- Bring in legal or banking partners for negotiation.

- Assign integration to an implementation specialist.

That’s not just smarter—it’s value engineering.

What Good Scoping Looks Like

- UMA clearly defined problem statement, not just a topic.

- Specific objectives linked to business outcomes, not just deliverables.

- A view of internal vs. external capabilities, so consultants are only used where needed.

- An initial hypothesis or decision framework, giving consultants direction without biasing results.

- Alignment with key stakeholders on what success looks like.

A strong scoping document reduces ambiguity, accelerates sourcing, improves proposal quality, and dramatically increases the odds of getting the results you actually want.

Don’t Scope in Isolation

Scoping is not an academic exercise. It requires deep collaboration between business sponsors, procurement, and—when possible—subject matter experts. It’s also a stage where procurement can add tremendous value, helping business lines articulate needs and avoid common traps like overscoping, bundling unrelated work, or recycling outdated RFP templates.

For a deeper dive into crafting effective requests for proposals, check out our guide: RFP for Consulting Made Easy.

2.2 Sourcing: Finding the Right Experts

Once you’ve defined what you need, the next value lever comes into play: sourcing the right consultants. It sounds simple—but in practice, it’s where many organizations default to what they know instead of what they need.

Too often, companies turn to the same three firms, issue an RFP to the usual suspects, or skip competition altogether. In doing so, they miss a critical opportunity—not just to save money, but to dramatically improve project impact.

Why Sourcing Drives Savings and Impact

The primary lever at this stage is savings. A well-structured competition can deliver cost reductions of 30–50% compared to sole-sourcing. That’s not theoretical—it’s based on actual project data. More importantly, competition creates negotiation leverage, improves proposal quality, and helps buyers understand the trade-offs between price, expertise, and delivery model.

But sourcing doesn’t just affect cost—it affects who you hire, and therefore the results you get. Consultants are not interchangeable. Selecting the wrong firm—even one with an impressive brand—can cut your impact by 25–50%.

The Danger of the Illusion of Competition

Let’s take a real-world example:

A telecommunications company consistently invites the same three large consulting firms to bid. On paper, this creates competition. But in practice, all three firms know they’ll be invited—and that if they lose one bid, another is just around the corner.

Over time, this creates a virtual oligopoly. The incentives shift. Why offer competitive pricing if relationships, not results, determine success? As a result, rates rise, innovation flattens, and impact erodes.

Without fresh blood in the pipeline, or without true consequence for underperformance, even the best consulting panels can stagnate.

What Strategic Sourcing Looks Like

- Creating a long list that includes new and specialized firms—not just big names.

- Right-sizing the competition—enough bidders for leverage, but not so many that quality suffers.

- Requesting customized proposals, not boilerplate decks.

- Evaluating based on fit, capabilities, and approach, not just reputation.

- Running a transparent process with structured Q&A, feedback loops, and clear decision criteria.

Procurement’s Role as a Market Maker

At this stage, procurement plays a key role in opening the aperture. Business sponsors may know one or two firms. Procurement can surface others—especially mid-sized players or boutiques with specialized expertise that offer better value for money.

Procurement can also level the playing field, ensuring each firm understands the context, the ask, and the criteria for selection. This leads to stronger proposals, better alignment, and ultimately, better project outcomes.

2.3 Selecting & Negotiating: Optimize for Impact, Not Just Price

After scoping the project and sourcing the right firms, the selection and negotiation phase may seem like a formality. You’ve done the hard work, right?

Not quite.

This is the moment where value becomes real. It’s where you choose your consulting partner—and define the rules of the game. Get it wrong, and even a well-scoped, competitively sourced project can lose traction before it starts.

Selection: More Than Picking the Lowest Price

Too many organizations treat selection as a price-driven decision. But unlike commodities, consulting outcomes depend heavily on fit, expertise, and engagement style. The cheapest firm may not be the most cost-effective—especially if they deliver low-quality work or burn time with misaligned approaches.

Selection is where you ensure the consultant:

- Understands the problem better than others.

- Brings a team that matches the challenge, not just a big name.

- Has a relevant, not generic, methodology.

- Shows the ability to co-create, not dictate.

Negotiation: A Tool for Value, Not Just Savings

Yes, negotiation can yield savings. Typical ranges are 5–15% off initial proposals—sometimes more. But price alone should not be your only focus. The true power of negotiation lies in reshaping the deal to maximize impact.

That includes:

- Refining the scope: Ensuring consultants are not doing tasks better handled internally.

- Adjusting staffing levels: Avoiding oversold teams or inappropriate seniority mixes.

- Rebalancing timelines: So project cadence aligns with internal readiness.

- Clarifying deliverables and success metrics: Preventing misunderstandings that derail execution.

Sometimes, simple reallocations—like replacing a partner-led team with an experienced manager and a subject-matter expert—can drive both savings and stronger results.

Urgency Kills Leverage

One of the most common traps? Letting urgency dictate process.

Picture this: an insurance company urgently needs consulting support for a transformation initiative. They approach one firm, convey the urgency, and ask for a proposal. The consultants know they’re the only option—and price accordingly.

Had the company taken a day to prepare a brief and identify at least one alternative, they would have preserved negotiation leverage—and likely saved 10–20% without sacrificing quality.

The Procurement Advantage

Procurement is uniquely positioned to orchestrate this phase with rigor. It can:

- Anchor the evaluation criteria and ensure they’re applied consistently.

- Manage reference checks, especially around similar past work.

- Lead commercial negotiations and define value-based pricing models.

- Align terms and conditions with enterprise standards and risk policies.

When done well, the result is not just a signed agreement—but the foundation for a successful engagement.

2.4 Managing: Driving the Project to Results

Once the contract is signed, many organizations breathe a sigh of relief. The deal is done. The project is launched. Time to let the consultants take over.

Except that’s precisely where many projects go sideways.

Consulting engagements don’t run on autopilot. They require proactive management, governance, and ownership—just like any internal transformation initiative. Without this, even the best consulting firm will struggle to deliver lasting value.

Why Managing Drives Cost Avoidance and Impact

The primary lever at this stage is cost avoidance. Poorly managed projects suffer from scope drift, misaligned expectations, stakeholder disengagement, and deliverables that are never used. In some cases, companies end up paying for work that yields zero strategic return.

But strong management does more than prevent loss. It directly enhances impact—by aligning the project to evolving priorities, enabling faster decision-making, and ensuring recommendations are actually implemented.

When Management Is Missing, Value Evaporates

Consider this scenario:

An industrial company launches a global benchmarking project to optimize its operations. The scope is solid, the consultants are qualified, and the initial engagement is promising. But halfway through, the project sponsor leaves. There’s no governance structure, no steering committee, and limited support from the rest of the leadership team.

The project stalls. Stakeholder buy-in erodes. By the time the final report is delivered, priorities have shifted, and the recommendations are shelved.

Não gerenciar o projeto adequadamente pode desperdiçar até 100% do custo do projeto (não contabilizando o tempo desperdiçado de suas equipes), e você pode falhar em obter o impacto que esperava do próprio projeto.

What Good Project Management Looks Like

- A named internal project owner empowered to drive the initiative forward.

- UMA steering committee including key decision-makers and stakeholders.

- UMA communication plan that keeps sponsors informed and engaged.

- Regular checkpoints and adjustments to scope, pace, or direction.

- Decision gates where critical choices are reviewed and endorsed.

Managing consultants isn’t about micromanaging. It’s about creating the conditions for success—and holding all parties, internal and external, accountable for outcomes.

Build Governance into the Contract

Strong project governance should start before the kick-off meeting. The Statement of Work (SOW) should define:

- Meeting cadences

- Roles and responsibilities

- Escalation paths

- Deliverable review processes

- Reporting formats

This ensures everyone is aligned from day one and sets clear expectations for collaboration.

Consulting ≠ Outsourcing

A common misconception is that hiring consultants means offloading ownership. It doesn’t. Consulting is a collaboration—where the client plays a critical role in decision-making, access, and implementation.

If your internal team is disengaged, if no one’s driving the bus, or if consultants are left to “do their thing,” you’ve already forfeited part of the value.

2.5 Measuring: Performance Is Not a Gut Feeling

Ask most companies how they measure consulting performance, and the answer is usually… they don’t. Or worse, they rely on informal opinions: “That went well,” or “Let’s not use them again.”

In a category that can represent millions in annual spend, that approach simply isn’t good enough.

Performance measurement in consulting is not just about evaluating results—it’s about building institutional memory, preventing repeat mistakes, and improving the ROI of future engagements.

Why Measuring Prevents Value Leakage

The primary lever at this stage is opportunity loss. Without a performance management system in place, companies risk repeatedly engaging consultants who are misaligned, overpriced, or lacking the required expertise.

That can translate into a 25% to 50% loss in expected impact—even if the project technically “delivers.” And when the wrong consultants are retained repeatedly, organizations waste budget that could have been reallocated more effectively.

On top of that, without visibility into performance, many companies unknowingly pay top-tier prices for work that lower-tier, specialized firms could have done better and cheaper.

Case in point:

A major U.S. retail bank hired a top-tier strategy firm to lead a branch network restructuring. While the firm had deep industry knowledge, it lacked real strength in organization design and change. The project was completed—but underwhelming. Worse, the firm later cited this project as a reference and secured similar work across the bank, propagating mediocre performance at premium rates.

What Should Be Measured?

A solid consulting performance framework should include both project-level e provider-level metrics.

At the project level, assess:

- Clarity and completeness of deliverables

- Adherence to timeline and budget

- Responsiveness and collaboration

- Measurable progress toward business objectives

At the provider level, track:

- Project outcomes across engagements

- Strengths by capability, industry, and format

- Pricing patterns and cost competitiveness

- Stakeholder satisfaction trends

A performance index or provider rating system—especially when built into your sourcing platform or procurement CRM—can dramatically improve future decision-making.

The Cost of Not Measuring

Let’s quantify the risk:

- If a firm underdelivers and captures only 50% of expected project impact, a project forecasted to return 600 in value only delivers 300.

- Add a premium consulting fee of 80 against a reference cost of 60, and the cost inefficiency grows.

- Multiply that by multiple projects annually, and you’re looking at millions in lost value.

Now compare that to the cost of implementing a basic performance review system. The ROI speaks for itself.

Build Feedback Loops into the Process

Here’s how to get started:

- Debrief every project, even the successful ones. Capture lessons learned, both technical and behavioral.

- Use structured scorecards to evaluate providers. Standardize the data collection across business units.

- Integrate findings into sourcing decisions, panel reviews, and ongoing contract negotiations.

- Close the loop: share feedback with consulting firms to drive accountability and improvement.

Measuring is not about punishment—it’s about learning. When done right, it helps good consultants shine, filters out poor performers, and continuously improves sourcing precision.

2.6 Focusing: Allocating Budget to What Truly Matters

Not all consulting projects are created equal. Yet many organizations allocate their consulting budgets as if they were—spreading resources thinly across dozens of minor initiatives, rather than concentrating firepower where it can deliver exponential returns.

That’s a missed opportunity.

The act of focusing—of deliberately prioritizing high-impact projects and defunding low-value work—is one of the most powerful levers for maximizing consulting ROI. Yet it’s rarely treated as part of the sourcing process.

Why Focusing Drives Strategic Impact

The main value lever here is impact. When you concentrate your consulting investment on a smaller portfolio of high-stakes, aligned, and well-managed projects, the results compound.

The secondary lever is cost avoidance. By eliminating unnecessary or redundant projects, you preserve budget that can be reinvested in more critical areas—or saved outright.

A well-run prioritization process can easily redirect 20–25% of annual consulting spend toward more valuable projects—without increasing total budget.

Consider this example:

A CPG company operated with a decentralized culture, where consulting budgets were managed at the department level. Historically, manufacturing and communications consumed most of the consulting spend, leaving little room for procurement or supply chain initiatives.

Over time, this imbalance led to underperformance in key operational areas. Despite spending millions, the company wasn’t funding the work that would drive long-term transformation. Without a centralized view or a value-based allocation model, high-ROI projects were left unfunded while lower-priority initiatives moved forward.

How to Focus Consulting Investments

To make better decisions about where to allocate consulting spend, organizations must adopt a demand management mindset—where all proposed projects are evaluated based on business impact, urgency, strategic alignment, and internal capabilities.

Key elements include:

- Central visibility over consulting pipeline and historical spend

- UMA review process for new project requests—governed by procurement or a transformation office

- Criteria to evaluate project ROI, criticality, and risk

- UMA scorecard or prioritization model to rank initiatives

- The courage to say “not now” or “not at all” to marginal projects

This approach doesn’t just drive better sourcing—it ensures consulting is treated as a strategic investment portfolio, not just an expense line.

The Cost of Misallocation

Let’s put numbers on it:

- Say your company spends $20M annually on consulting.

- If 25% of that budget is redirected from average to high-performing projects, and those projects deliver 2x the impact, you’re looking at a net gain of $10M in value—with zero increase in spend.

That’s not optimization—it’s transformation.

3. The Value Equation: More Than Just Savings

By now, it should be clear: not all value from consulting is visible on an invoice. In fact, the biggest returns are often invisible to traditional procurement dashboards. They’re embedded in cost avoidance, unlocked through better scoping, and captured in long-term business impact.

That’s why mature organizations are reframing how they assess the value of consulting—moving beyond cost-based metrics to a multi-dimensional equation.

Let’s break it down.

3.1 The Simplest View: Willingness to Pay Minus Price

The most basic lens on consulting value is perceived savings:

Perceived Value = Willingness to Pay – Actual Price Paid

If you were prepared to pay $100K for a strategy engagement and negotiated it down to $80K, you could argue that you “saved” $20K. But this is simplistic. Willingness to pay is subjective and highly variable—anchored by internal expectations, not market benchmarks or actual value delivered.

3.2 The Market-Based View: Reference Cost Minus Actual Price

A more robust method compares your actual spend to a reference cost—the average price you would have paid based on similar proposals.

Measured Savings = Reference Cost – Actual Price

Let’s say you paid $80K, and the average market proposal was $90K. That’s a $10K measured savings, grounded in market data. But even this model overlooks a major factor: did you buy more than you needed?

3.3 The Strategic View: Savings + Cost Avoidance + Impact Multiplier

To fully understand consulting value, we need a three-part model:

Total Value = Measured Savings + Cost Avoidance + Captured Impact

Let’s define each component.

✅ Measured Savings

Savings from negotiation and sourcing versus comparable market prices.

✅ Cost Avoidance

Savings created by scoping tightly and avoiding unnecessary work.

For instance, optimizing scope might save $30K in avoidable fees by removing redundant or low-value tasks.

✅ Captured Impact

The value created by the project itself—operational efficiencies, growth enablement, transformation gains.

This is the multiplier that justifies the investment.

3.4 Putting Numbers to the Equation

Let’s walk through a full example:

- Reference Cost for the project: $90K

- Actual Cost after negotiation: $80K → Measured Savings = $10K

- Scoping Optimization Savings: $30K → Cost Avoidance = $30K

- Expected Business Impact: $600K over 12 months

- Discount Rate for NPV: 10% → 10-year value = $600K × 7 = $4.2M

- Realized Impact (assuming 50% execution effectiveness): $2.1M

- Total Value = $10K (savings) + $30K (avoidance) + $2.1M (impact)

- Result = $2.14M in captured value from an $80K investment

That’s a 26x return—and illustrates why sourcing decisions must focus on impact, not just cost.

3.5 Why Impact Trumps Everything

Here’s the strategic truth: unless your expected returns are low, impact is almost always the dominant value driver.

If a project’s expected return is below 3x, cost optimization matters more. But once returns exceed that threshold—which is the case for most strategic consulting work—then sourcing the right partner, managing execution well, and aligning stakeholders become far more important than negotiating an extra 5% off fees.

3.6 Your Three Value Levers in Summary

| Lever | Primary Focus | Driven By |

| Savings | Negotiation & Competition | Procurement process excellence |

| Cost Avoidance | Scope Optimization | Demand management & sourcing design |

| Impact | Project Execution & Fit | Consultant quality, governance, stakeholder alignment |

In the next section, we’ll explore how organizations typically focus their efforts—and where they should refocus if they want to unlock consulting’s full potential.

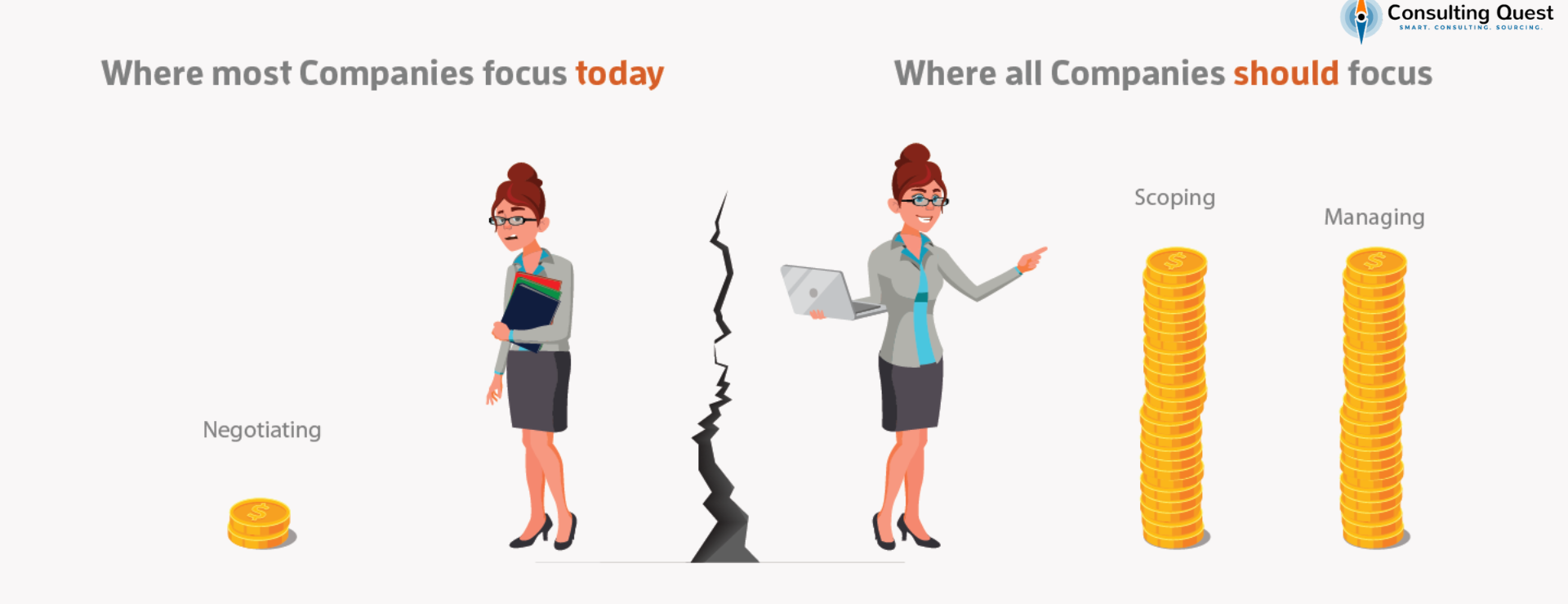

4. Where Companies Focus Today vs. Where They Should

Knowing how value is created is one thing. Aligning your internal processes and priorities to capture that value is another. In practice, many companies focus their energy on the parts of the consulting sourcing process that are easiest to control—or easiest to measure—rather than those that yield the greatest returns.

This misalignment is not just a missed opportunity. It actively undermines the effectiveness of consulting engagements and the ROI they can generate.

4.1 Where the Focus Is Today

In most companies, especially those with decentralized or category-agnostic procurement teams, consulting sourcing is still managed like any other indirect spend. Procurement’s involvement often starts late—after the business has already decided on a need and, in some cases, even selected a preferred firm.

As a result, most of the effort is placed on the back end of the process:

- Negotiating discounts

- Reviewing pricing models

- Checking contract terms

- Running RFPs with a limited shortlist

In these environments, success is measured primarily in terms of price savings—not value delivered. This is partly due to procurement KPIs that still emphasize spend reduction, and partly because consulting is perceived as too “strategic” or “sensitive” to be fully integrated into procurement governance.

Meanwhile, escopo, consultant selection, gestão de projetos, e post-project performance review are either underinvested or left entirely to the business sponsor—who may or may not have the expertise, time, or incentive to manage those steps rigorously.

4.2 Where the Focus Should Be

Mature organizations are flipping the script.

Instead of focusing primarily on price, they concentrate on the steps that shape the actual business outcome. These include:

- Scoping the right problem (Cost avoidance + impact)

- Sourcing the right consultants (Impact)

- Managing the project actively (Impact)

- Measuring performance (Cost avoidance + impact)

- Prioritizing high-ROI projects (Portfolio-level value)

These are the stages that create long-term strategic and financial benefits. And yet, they’re often under-supported, under-funded, or unstructured.

That’s where strategic procurement can step in—not to impose bureaucracy, but to bring discipline, insight, and leverage to the parts of the process that matter most.

4.3 Why the Shift Matters

Let’s revisit the value equation from the previous section:

Total Value = Savings + Cost Avoidance + Captured Impact

Now ask: where do most procurement teams actually focus?

Primarily on the left-hand side—savings. But unless a project has a very low expected return, that’s not where most of the value lives.

If your average project has an expected ROI of 5x or higher—which is typical for well-scoped consulting initiatives—then even small changes in impact capture far outweigh modest differences in price.

Por exemplo:

- A 10% improvement in captured impact on a project with $1M in potential return delivers $100K in value.

- A 10% savings on a $200K project only delivers $20K.

That’s a 5x difference—and it illustrates exactly why the focus must shift.

4.4 How Leading Companies Are Refocusing Their Efforts

The most advanced consulting procurement functions are adopting an integrated approach, often anchored in three core principles:

✅ 1. Value-Based Demand Management

They treat consulting as a strategic investment, not just an operating expense. Every project must justify its place in the portfolio—not just by internal urgency, but by expected ROI.

✅ 2. Fit-Driven Consultant Selection

They assess providers not only on pricing, but on expertise, approach, cultural fit, and historical performance. The “usual suspects” no longer get a pass.

✅ 3. Impact-Oriented Project Oversight

They ensure governance is embedded from day one: clear goals, structured milestones, executive sponsorship, and regular performance reviews.

This doesn’t mean procurement controls everything. In fact, the best models involve strong collaboration between procurement and business stakeholders. But it does mean moving beyond tactical sourcing to true consulting category management.

4.5 Bridging the Gap: Procurement as a Strategic Enabler

To support this shift, procurement must evolve its own mindset:

- From spending less → to enabling more

- From cost-centric → to value-focused

- From transactional oversight → to strategic orchestration

That means rethinking KPIs, investing in consulting-specific tools and frameworks, and building internal credibility as a value partner, not just a cost controller.

Because at the end of the day, value from consulting is not just what you pay—it’s what you unlock.

5. How to Operationalize a Value-Driven Approach

Understanding the consulting value equation is a start. Aligning your sourcing efforts to high-impact levers is progress. But the real transformation happens when you embed those principles into your organization’s way of working.

That’s where many initiatives stall—not for lack of strategy, but for lack of structure. This section outlines how to turn insight into action, and how to systematize value creation across the full consulting lifecycle.

5.1 Build a Robust Demand Management Process

If consulting is a strategic investment, it deserves a rigorous intake and prioritization process. That starts with visibility—who is using consulting, for what, and why?

Mature organizations build centralized visibility into:

- Project requests and business cases

- Forecasted spend by function and initiative

- Expected vs. actual outcomes

- Frequency and concentration of provider usage

From there, they implement a lightweight, value-based review process to ensure:

- The right problems are being addressed

- Internal capabilities are considered first

- Consulting is used where it creates leverage, not convenience

A well-structured demand management system can redirect 20–30% of spend toward higher-ROI projects—without increasing the budget.

5.2 Develop a Consulting-Specific Sourcing Framework

Consulting is not like buying office supplies or temp labor. It requires a tailored sourcing playbook—one that reflects the unique nature of expertise-driven, outcome-focused work. As detailed in our How to Buy Consulting Guide, effective sourcing strategies hinge on several core elements. They include:

- Pre-scoping tools and templates to help business lines define needs clearly

- Curated supplier shortlists based on domain, geography, and performance

- Capability-fit matrices to evaluate technical and cultural alignment

- Pricing benchmarks and rate cards by seniority, geography, and format

- Standardized RFP and proposal evaluation criteria

This ensures the process is consistent, yet flexible enough to adapt to different project types—whether strategic, operational, digital, or organizational.

5.3 Embed Governance Into Every Project

As discussed in Section 2.4, even the best consulting strategy can fail without strong project governance. To operationalize governance, organizations should:

- Require a named internal sponsor with decision authority

- Estabelecer milestone-based tracking (not just delivery dates)

- Crio steering committees for major initiatives

- Include regular checkpoints for scope review and course correction

- Mandate project closure reports—including results vs. expectations

These governance structures not only protect value, but also create data that feeds into future performance reviews and sourcing decisions.

5.4 Measure Consultant Performance Consistently

What gets measured gets improved.

To scale consultant performance management, you need both structure and repetition. Best practices include:

- Post-project evaluations with stakeholder surveys and scorecards

- Performance tracking at the firm, team, and individual consultant level

- Feedback loops that inform future RFPs, panel reviews, and pricing decisions

- Balanced scorecards covering quality, collaboration, expertise, and ROI

Over time, this creates a data-driven memory system—enabling smarter decisions with each engagement.

5.5 Professionalize the Role of Consulting Procurement

Perhaps most importantly, organizations must build internal capabilities to manage consulting as a strategic category.

That means investing in:

- Dedicated category managers for consulting or professional services

- Training programs for procurement teams on consulting-specific challenges

- Internal education for business stakeholders on value-based sourcing

- Digital platforms to centralize spend, projects, and provider data

It also means creating a clear governance model between procurement, finance, and business leadership—so decisions are made collaboratively and aligned to strategic goals.

5.6 What It Looks Like in Practice

When operationalized well, a value-driven consulting procurement model delivers:

| Element | Traditional Model | Value-Driven Model |

| Project Intake | Reactive, ad hoc | Structured, value-based |

| Supplier Selection | Relationship-driven | Fit- and impact-driven |

| Fixação de preços | Negotiated late in process | Benchmarked and optimized early |

| Governança | Informal or missing | Structured with milestones and sponsors |

| Performance Measurement | Subjective and inconsistent | Systematic and data-driven |

| Procurement Role | Cost gatekeeper | Strategic value enabler |

In short, operationalizing value means shifting from individual project firefighting to portfolio-level performance management. It’s about embedding the right tools, governance, and behaviors to ensure consulting spend consistently delivers on its promise.

6. Conclusion – Focus Where Value Is Created

The consulting sourcing process is often treated as a procurement exercise. But in reality, it’s a performance system—one that determines whether consulting becomes a lever for transformation or just another line item on your budget.

As we’ve seen, not all steps contribute equally to value. Negotiating lower prices might feel like a win, but if you’re solving the wrong problem, picking the wrong partner, or failing to manage execution, those savings are quickly eclipsed by lost impact.

That’s why the smartest organizations are flipping the traditional approach. Instead of over-indexing on price, they’re placing deliberate focus on:

- Scoping with precision to avoid waste and enable better outcomes.

- Sourcing for fit, not familiarity.

- Managing projects proactively, with real governance and sponsorship.

- Measuring performance to build institutional knowledge and accountability.

- Focusing resources where consulting creates the most strategic value.

And they’re doing it not through bureaucracy, but through thoughtful systems—demand management, fit-for-purpose sourcing frameworks, project oversight, and performance data that fuels continuous improvement.

Because here’s the truth:

Unless the expected returns are very low, the impact of the project itself will always outweigh the savings you can achieve through negotiation.

When you understand that—and structure your sourcing efforts accordingly—you don’t just control spend. You multiply value.

Your Next Step

If you’re ready to move beyond cost containment and start building a value-driven consulting procurement model, we’re here to help.

At Consulting Quest, we specialize in helping companies redesign their consulting sourcing approach—from playbooks and panels to platforms and performance systems.

Let’s talk about how you can unlock the full ROI of your consulting investments.

👉 Book your free consultation with our team and start building a smarter, impact-driven approach to consulting sourcing.