Table of Contents

Let’s face it—consulting is the outlier in your otherwise well-oiled category management system.

You’ve implemented solid processes. You’ve standardized sourcing playbooks. You’ve optimized IT, marketing, logistics—even those sneaky MRO categories. But when it comes to consulting, things start to look… fuzzy. The usual rules don’t quite apply, and the result? It’s often a spend category that’s opaque, decentralized, and flying under the radar.

And you’re not alone. Whether you’re a CPO overseeing a global procurement function or a category buyer responsible for managing indirect spend, chances are consulting feels like the Wild West of your procurement portfolio—high value, high stakes, but not nearly as well-governed as it could be.

But here’s the kicker: Consulting shouldn’t be the exception to your procurement excellence — it should be a strategic category in its own right.

We’ve spent years working with organizations of all shapes and sizes at Consulting Quest and Consource, and one thing is clear: when consulting is treated with the rigor and nuance it deserves, the results are transformational. From 10–30% cost savings to real strategic alignment with business goals, the upside is too big to ignore.

And yet, many companies still group consulting under the catch-all of “professional services,” lumping it in with legal, engineering, or even real estate. But consulting isn’t just another service—it’s a strategic enabler. A lever for change. A tool for growth, transformation, and competitive edge.

That’s why this article exists.

We’re not going to give you a generic overview of category management. We’ll assume you’ve got the basics covered. Instead, we’re going to dig into how category management can be adapted—and elevated—for consulting. We’ll unpack what makes it different, what success looks like, and how to actually drive performance, visibility, and value in this complex space.

Here’s what we’ll cover:

- Why consulting deserves its own strategic category

- How to structure your spend analysis, supplier panels, and contracts

- How to manage tail spend and get more value from mid-tier firms

- Why evaluating partners, not just firms, is critical

- And how to build a playbook that actually works for your business

Whether you’re starting from scratch or refining an advanced model, this guide is designed to challenge your thinking and offer real, actionable strategies.

Because it’s time to bring consulting in from the frontier — and make it a model of category excellence.

What Is Category Management Really About?

Let’s take a step back—just for a moment. Because before we dive into consulting-specific challenges, it’s worth revisiting what category management is supposed to do.

At its core, category management is about shifting procurement from a transactional function to a strategic business enabler. The Chartered Institute of Procurement & Supply (CIPS) defines it as a “strategic approach which organizes procurement resources to focus on specific areas of spend.” That means managing each category—whether it’s IT, logistics, or consulting—as its own mini-business, with tailored strategies, supplier relationships, and performance metrics.

Sounds great, right? That’s because when done right, the benefits are massive:

- Reduced total cost of ownership (TCO)

- Better alignment with internal stakeholders

- Improved supplier performance

- Greater innovation and agility in the supply chain

And it’s not just theory. According to a McKinsey report on procurement transformations, organizations that fully adopt category management can unlock savings of up to 12% per category—while boosting internal satisfaction and compliance.

But here’s the kicker: category management is not the same as strategic sourcing. They’re often used interchangeably, but they serve different purposes.

Let’s break it down.

| Strategic Sourcing | Category Management |

| Focuses on one-off procurement events | Focuses on long-term value creation |

| Typically led by project teams | Led by dedicated category managers |

| Emphasizes price and cost reduction | Emphasizes TCO, risk, performance, and value |

| Reactive to needs | Proactive, forward-looking strategy |

Think of strategic sourcing as a tactical sprint, and category management as a marathon—with data, insight, and stakeholder alignment as your fuel.

And here’s the thing: this methodology works beautifully across a wide range of spend categories. When you’re buying laptops, raw materials, or marketing services, category management helps you get leverage, standardize specs, consolidate volume, and manage supplier performance. It creates control out of chaos.

So why doesn’t it always work for consulting?

We’ll get to that in a moment. But spoiler alert: it’s not because the methodology is broken—it’s because consulting hasn’t been given the structure, resources, or strategic attention it deserves.

And that’s exactly what we’re here to fix.

So Why Does Consulting Escape the Rules?

Now that we’ve established how well category management works for other spend areas, let’s address the elephant in the room: why does consulting still get a free pass?

We hear this all the time from procurement leaders:

“We’ve got strong governance in place for most categories—IT, logistics, even contingent labor. But consulting? It’s a black box.”

And honestly, they’re not wrong. Despite its high strategic importance and budget footprint, consulting often escapes the rigor of structured procurement. Here’s why:

1. It’s Often Misclassified

Consulting is frequently lumped into “Professional Services” or buried in “Indirect Spend.” It gets bundled with legal, engineering, even travel expenses. That makes it nearly impossible to apply tailored strategies—because you’re not even treating it as a distinct category.

Yet, consulting has a completely different function, value model, and supplier landscape. It’s a homogeneous market with discrete dynamics, deserving of its own spotlight.

2. It’s Intangible and Project-Based

Unlike tangible goods or standardized services, consulting is fluid. Deliverables are nuanced. Outcomes can be hard to measure. It’s built on people, expertise, and trust—making apples-to-apples comparisons nearly impossible without the right frameworks in place.

This fuzziness often leads stakeholders to bypass procurement entirely. “We know this firm,” they say. “They’ve worked with us before. Let’s just go with them again.” Sound familiar?

3. Stakeholders Hold the Cards

In most categories, procurement leads the process. But in consulting, the business sponsor usually drives the selection. And let’s be honest—sometimes they view procurement’s involvement as a threat to their autonomy or speed.

This creates a tricky dynamic: how do you bring structure without alienating internal clients?

(We’ll cover this later, but spoiler alert—it starts with collaboration, not control.)

4. It’s Not Seen as a Lever for Value

Many companies see consulting as a cost to manage, not a strategic asset to optimize. That mindset limits the application of category management principles like performance evaluation, panel strategies, and ROI measurement.

But here’s the truth: consulting is often one of the biggest untapped opportunities for value creation. We’ve seen clients unlock 20–30% more value—not just through pricing, but through better supplier fit, clearer scopes, and smarter delivery models.

So no, the issue isn’t with category management. It’s with how consulting has been shoehorned into models that weren’t built for it.

But what if we flipped the script?

What if we treated consulting as a standalone category—one with its own strategy, playbook, performance metrics, and governance?

In the next section, we’ll explore exactly why that shift is not only possible—but necessary.

Making the Case: Consulting as a Standalone Category

If you’re still wondering whether consulting really deserves its own category… you’re asking the right question.

Because while most procurement teams already feel that consulting is different, few have actually made the organizational leap to treat it as a distinct and strategic category. But the data—and experience—backs it up.

Let’s break it down.

1. A Unique Function with a Strategic Role

Consulting doesn’t function like legal services or IT support. It’s not just about service delivery—it’s about enabling transformation. Whether it’s a digital roadmap, market entry strategy, or an operational overhaul, consulting is often driving mission-critical decisions across the business.

As we like to say at Consulting Quest, “consulting is a lever for accelerating strategy.” That’s why it has to be tightly aligned with executive priorities, not buried in the weeds of general services.

2. It Fits the Definition of a True Category

In his book Category Management in Purchasing, Jon O’Brien lays out a clear framework for identifying what constitutes a standalone category. According to him, a procurement category should be:

“A discrete marketplace, large enough to offer strategic opportunities, small enough to manage, and homogeneous enough in its supplier landscape and client expectations to be treated with a tailored approach.”

By that definition, consulting is a textbook example.

It has:

- A clearly defined and visible supply market

- Global players and specialist boutiques competing on the same terms

- A shared objective across clients: enabling transformation and delivering business value

It’s not an amorphous service pool—it’s a structured, dynamic market with its own rules. And that makes it ripe for true category treatment.

3. It’s Small Enough to Manage—Big Enough to Matter

Consulting may not dominate your spend report, but it certainly punches above its weight. Most large companies spend 0.5% to 3% of their revenues on consulting. That’s significant—especially when you consider the strategic impact those projects have on the business.

Now compare that to travel or office supplies—categories that have fully developed procurement strategies. Why wouldn’t we apply the same rigor to something that directly shapes strategic decisions?

The kicker? Consulting spend is typically concentrated. You’re likely working with a core group of 10 to 20 suppliers who account for most of your engagements. That makes the supplier base not only strategic—but incredibly manageable.

4. It’s Homogeneous—With High Stakes

Yes, the consulting industry is vast. But in many ways, it’s also surprisingly uniform. Most firms—regardless of size—operate under similar delivery models. They staff engagements with teams led by partners, deliver frameworks and roadmaps, and charge based on daily rates or fixed fees.

What varies isn’t the model—but the quality of execution. And that’s exactly what category management is built to address: finding the right match, at the right time, for the right need.

5. When Managed Right, Consulting Delivers Measurable Value

We’ve seen it across dozens of client engagements at Consulting Quest: organizations that elevate consulting to a true category unlock not just savings—but real performance improvement and ROI.

They:

- Improve alignment with internal stakeholders

- Create smarter scopes of work

- Track supplier performance down to the partner level

- Reduce tail spend and duplication

- And make more informed, strategic decisions about when and how to use external help

So yes—consulting absolutely deserves to be a standalone category. The problem isn’t that it doesn’t fit. It’s that it’s been misclassified, mismanaged, or simply misunderstood.

Time to change that.

Key Success Factors for Consulting Category Management

So you’ve recognized consulting as a standalone category. You’ve defined your goals—savings, value, control, alignment. But now comes the tough part: making it work in practice.

Category management for consulting isn’t plug-and-play. It requires a shift in mindset, behavior, and processes. But when done well, it transforms consulting from a cost center into a true strategic lever.

Here are the key ingredients for success:

1. Deep Knowledge of the Consulting Market

Let’s start with the obvious: you can’t manage what you don’t understand.

Consulting is a fast-moving, complex, and often opaque market. Firms pivot service offerings, merge, split, rebrand, and shift industry focus all the time. And new players emerge regularly with niche expertise and agile delivery models.

To stay ahead, your category lead needs to:

- Stay current on market trends and emerging players

- Understand consulting delivery models and pricing structures

- Know which firms are best for what types of projects

- Monitor regulatory or strategic shifts in key industries

💡 Pro tip: Use Improveo.app to stay ahead of the curve. It’s a unique platform where you can:

Explore thought leadership from consulting firms across sectors

Track trends and insights shaping your industry

Define your transformation trajectory or find the right consultants for specific needs

And don’t forget to visit our Insights section on Consulting Quest, where we regularly share expert analysis, market updates, and practical guides. Subscribe to our newsletter to get the latest straight to your inbox—curated for procurement professionals like you.

2. Embedded Collaboration with Stakeholders

Let’s address the elephant in the room: stakeholders sometimes see category managers as the enemy. Someone who adds steps, slows them down, or cuts corners on their “preferred” consultant.

To flip that narrative, you need to become a partner, not a policeman. That means:

- Engaging early in the project scoping phase

- Listening to stakeholder priorities and translating them into procurement strategies

- Bringing valuable market intel to the table

- Helping them avoid bad experiences (like a misaligned supplier or a bloated SOW)

When stakeholders see you adding value — not just enforcing process — they’ll invite you into the room earlier. That’s where the magic happens.

3. Continuous Evolution: Not “Set It and Forget It”

Unlike other categories, consulting is dynamic. Your strategy shouldn’t be static either.

Market conditions shift. Your internal needs evolve. Supplier capabilities expand or contract. That’s why a successful consulting category strategy needs to be reviewed and updated regularly—ideally two to four times a year, as noted in many high-performing organizations we’ve worked with.

Don’t just build a strategy—build a rhythm for adapting it:

- Quarterly reviews with key stakeholders

- Annual refresh of panel suppliers

- Real-time feedback loops on project outcomes

🔄 Think of it like lifecycle costing for consulting: you’re constantly tuning the engine to get peak performance.

4. A Balanced Focus on TCO and ROI

Most procurement functions are wired to focus on Total Cost of Ownership (TCO). That’s still important—but in consulting, we have to think bigger.

Here, ROI matters just as much. You need to ask:

- What impact did this project have on the business?

- Did it accelerate time to market? Improve EBITDA? Unlock growth?

- Was the cost justified by the value delivered?

That doesn’t mean ROI has to be perfectly quantified. But it does mean you need frameworks to assess the real business outcomes—not just how much you spent.

📊 Framework idea: Use post-project evaluations that assess impact, transfer of knowledge, stakeholder satisfaction, and reuse of IP.

5. Clear Governance, Without Overkill

Finally, success depends on just enough governance—not too little, not too much.

Overengineer your process, and business lines will go around you. Under-regulate it, and you’ll lose control and insight.

The sweet spot? A framework that includes:

- Project thresholds for procurement involvement

- A standard SOW template with key clauses pre-loaded

- Competitive bidding guidelines by project size

- Prequalified supplier panels for faster sourcing

- A central repository of consulting spend and performance data

This creates structure, but leaves room for speed and flexibility—especially for urgent or niche projects.

Spend Analysis: Your First Strategic Lever

Let’s play a quick game. Ask yourself: “How much did we spend on consulting last year?”

Now, try answering these follow-ups:

- Which departments used the most consulting support?

- What kind of projects were they running?

- Did we get good value from them?

- Did we use the right firms for the right jobs?

If you’re sweating a little—or pulling out an Excel sheet you haven’t opened since Q1—don’t worry. You’re not alone.

In fact, consulting spend is notoriously tricky to track, even for the most mature procurement teams. It’s scattered across business units, coded inconsistently, and often buried in vague line items like “professional services” or “advisory fees.”

But here’s the good news: spend analysis is your best friend when it comes to taking control of consulting as a category. And more importantly—it’s your first strategic lever.

🔍 Why Spend Analysis Matters

Think of spend analysis like a GPS for your consulting category. Before you can optimize where you’re going, you need to know:

- Where you’ve been

- What routes you’ve taken

- And where the detours and tolls are

A solid spend analysis helps you:

- Get visibility on your total consulting expenditure (yes, even those sneaky shadow budgets)

- Identify duplication across departments or overlapping scopes

- Benchmark suppliers and pricing more accurately

- Spot quick wins for savings or better supplier fit

And it sets the stage for smarter decisions down the road—like panel design, negotiation tactics, and even internal demand management.

🧠 How to Do It Right (Without Losing Your Mind)

Let’s keep it simple. A great consulting spend analysis follows four key steps:

1. Get Your Data House in Order

Start by gathering all consulting-related spend data across your organization. Pull it from finance, procurement systems, and even manually from departments if needed. It won’t be clean—but don’t let that stop you.

🎯 Quick tip: Include all indirect consulting expenses. Things get missed under different GL codes or vendor names (e.g., “ABC Ltd.” vs. “ABC Consulting”) or misallocated in your procurement taxonomy.

2. Categorize by Type, Not Just Supplier

This is where most analyses go wrong. Don’t just group by vendor—break down projects by capability or purpose: strategy, operations, HR, digital, etc. You’ll get much more useful insights than just knowing how much you spent with “McBain Consulting.”

Use a flexible taxonomy that reflects your organization’s priorities and recurring project types.

3. Evaluate ROI, Not Just Cost

Numbers alone don’t tell the whole story. Go back to the original objectives of each project. What was promised? What was delivered? Were the stakeholders happy?

You’re not just managing a budget—you’re managing value.

💬 Need help figuring that out? Tools like Consource offer built-in analytics and ROI dashboards tailored to consulting spend. They help you compare project outcomes, supplier effectiveness, and even spot future optimization areas—all without drowning in spreadsheets.

4. Identify Patterns and Leverage Points

Now comes the fun part: use your analysis to start drawing strategic conclusions.

- Are you over-relying on a small group of firms?

- Could similar work be bundled or sourced more competitively?

- Where are your hidden “tail spend” buckets?

- Which teams consistently deliver successful projects—and which need support?

📘 For a step-by-step breakdown of this process, we recommend checking out our Consulting Spend Analysis Guide. It’s a practical roadmap designed specifically for procurement teams looking to drive real impact through insight.

🚀 From Data to Decisions

The goal of spend analysis isn’t just to clean up your data. It’s to unlock smarter, faster decisions across your consulting ecosystem. It helps you go from reactive fire-fighting to proactive planning.

And once you have that clarity? You’re ready to build supplier panels, negotiate smarter contracts, and align consulting with your business strategy in a way that actually sticks.

It’s not glamorous. It’s not easy. But it’s the foundation of everything else.

Because in the world of consulting category management, spend analysis isn’t a box to check—it’s your compass.

Absolutely—this is a crucial, nuanced section and your points are spot-on. Let’s craft it with the same engaging, professional, and educational style—infused with your unique thought leadership and a touch of real-talk honesty.

Understanding the Market for Consulting Services

Let’s bust a myth right out of the gate: “Consulting is just another professional service.”

Spoiler alert—it’s not. And if you treat it that way, you’ll end up overpaying, under-delivering, and scratching your head at why the results aren’t matching the spend.

Not Your Average Supplier Ecosystem

Most procurement categories operate in relatively defined supplier landscapes. You’ve got manufacturers, distributors, and maybe some service integrators. Simple enough.

But consulting? It’s a different beast altogether.

You’re dealing with firms that:

- Sell intangible value (ideas, insights, strategies)

- Operate with variable team structures depending on the project

- Often promise broad capabilities—some of which may be more sales pitch than substance

That last point is critical. Because while some firms can deliver across multiple domains, many are simply playing the account game—cross-selling, up-selling, and side-selling in a bid to secure long-term revenue streams. That’s how they stay profitable: by keeping their teams staffed and the revenue flowing.

And let’s be clear—this isn’t just a “Big Four” problem. Boutique firms do it too. Sometimes with less internal oversight and more reliance on a charismatic partner’s network.

So what do you do about it?

🧬 Understand the Consulting DNA

Every consulting firm has a unique “DNA”—a set of embedded traits, behaviors, and capabilities that defines how they operate, what they’re good at, and how they deliver.

We unpack this deeply in our guide Understanding the Essence of Consulting DNA, but here’s the gist:

- Some firms are thinkers—great at strategy, not so hot at implementation

- Others are doers—excellent operators, but lacking in high-level vision

- Some thrive on long-term transformation, while others live for quick wins

- And many will tell you they “do it all”—but that doesn’t mean they do it well

As a procurement leader, your job is to see past the glossy proposal decks and understand the real DNA of the firms you’re engaging.

Are they stretching beyond their core? Are they just filling a seat on the bench? Or are they truly the best-fit partner for this specific challenge?

🧭 Segment Smarter: Go Beyond the Logo

It’s tempting to divide your consulting suppliers into “big names” and “everyone else.” But you’ll miss massive value if you stop there.

Instead, think in terms of capabilities, industries, and engagement models:

- By capability: Strategy, operations, digital, org design, etc.

- By industry focus: Healthcare, energy, financial services, etc.

- By engagement model: Advisory vs. execution vs. interim staffing

Then map your recurring business needs to these segments.

You’ll quickly see where your supplier panel has strengths, where it’s over-concentrated, and where you might need to bring in new blood—especially from mid-sized or niche firms with deep expertise.

💡 Tool tip: Platforms like Consource—powered by Improveo.app—can be game-changers here. They help you see beyond the pitch, offering real-time visibility into a firm’s capabilities, industries, positioning, and thought leadership. Instead of relying solely on slide decks or referrals, you get data-driven insight into who’s truly fit for the job—so you can source with confidence and precision.

🚫 Avoid “One-Size-Fits-All” Sourcing

Some firms claim to do it all. They have strategy arms, operations experts, tech divisions, implementation squads… It looks impressive. But be cautious.

Because their real business model is often focused on:

- Expanding the scope mid-project

- Cross-selling adjacent services

- Keeping their teams billable—not necessarily delivering the best result

And let’s be honest—when your project turns into a staffing puzzle to keep their pyramid full, you stop being the client and start being the revenue stream.

This doesn’t mean you should avoid full-service firms. It just means you need to be smart:

- Validate their expertise in the specific area you’re sourcing

- Compare with specialized boutiques

- Don’t let convenience trump capability

🤝 Final Thought: Choose Fit Over Familiarity

In consulting, success doesn’t come from working with the biggest name—it comes from working with the right partner for the job. That might be a tier-one strategy firm—or it might be a niche expert who knows your sector inside out.

Either way, you need a clear, data-backed view of your supplier landscape, and the courage to challenge one-size-fits-all sourcing logic.

Because in this market, smart segmentation beats blind loyalty every time.

Panel Management & Master Service Agreements (MSAs)

Let’s be real: when it comes to managing consulting suppliers, you don’t want to start from scratch every single time.

You need structure. You need speed. You need sanity.

That’s where Consulting Panels and Master Service Agreements (MSAs) come into play. When done right, they help you bring order to the chaos. When done wrong… you end up locked into inflexible relationships, drowning in admin work, or—worse—handing 80% of your budget to the same firm that pitched you over breakfast.

Let’s unpack how to get this right.

🧩 Panel Management: Curate, Don’t Consolidate Blindly

Panel rationalization is a classic procurement lever. And yes, it works—but with consulting, you’ve got to handle it differently.

We’ve seen companies go from 80 suppliers to 5 “preferred” firms. Sounds efficient, right? Except one U.S. mid-market client we worked with ended up giving 75% of their spend to one Big Four. Strategy, operations, supply chain, IT—you name it, they got it. Premium pricing across the board, minimal competition, and zero diversity of thought.

The result? Same faces, higher costs, and diminishing returns.

💡 Lesson: Don’t build your panel like you’re building Noah’s Ark. You don’t need one firm per category—you need the right mix for your needs.

Here’s how to think about it:

- Segment by capability (not just brand): Strategy, operations, tech, org design, etc.

- Balance global and boutique: Big names offer scale; boutiques often deliver sharper expertise.

- Leave space for specialists: Some projects deserve a niche player, not your default panel firm.

For a deeper dive into effectively segmenting consulting firms and understanding their capabilities, refer to What Is Consulting: A Comprehensive Guide to Value, Capabilities, and Best Practices.

And above all, review panel performance regularly. A consulting panel should evolve with your business—not gather dust like an outdated vendor list.

📜 MSAs: More Than Just Paperwork—They’re Leverage

Let’s skip the basics. You’re a procurement pro—you already know what an MSA is. But in consulting, an MSA isn’t just about saving time or avoiding re-negotiation hell. It’s about unlocking real strategic value—for both sides.

Why MSAs Matter More in Consulting

Here’s the deal: when you offer consulting firms predictability and visibility, you create leverage. And that leverage translates into better conditions, like:

- Preferential rates across capabilities or geographies

- End-of-year rebates based on spend volumes

- Defined staffing models (and escalation paths if things go off-track)

Why? Because consulting firms crave utilization and continuity. Their business model lives and dies on keeping teams billable. So when you signal “we want to work with you often and at scale”, they’ll negotiate.

Use this leverage wisely.

🎯 Don’t just chase lower day rates. Focus on:

- Who’s going to staff your projects

- What seniority levels are included at each rate

- How fast they can mobilize for urgent work

- What guarantees they’ll provide around continuity

Your MSA strategy should serve two core goals

- Harmonize Your Conditions

- Across all projects and regions, align your terms once—then stop wasting time debating NDAs and indemnity clauses on every engagement.

- Define the financial logic: discounts, rebates, pricing tiers.

- Clarify ownership: IP, knowledge, and outputs should be clearly assigned.

- Deploy Templates

- Don’t reinvent the wheel. Build a solid MSA template you can use across firms with minor tweaks.

- Templates mean faster onboarding, less back-and-forth, and less legal exposure.

- Add annexes for specific topics: rate cards, escalation policies, or ESG clauses.

👀 Real story: A client of ours was spending half their procurement team’s time on contract negotiations—MSAs, SoWs, redlines, the whole circus. Once we helped them implement a standard MSA playbook, contract lead time dropped from 15 days to 3. Multiply that across 30+ projects a year and… yeah, you get it.

💡 Pro tip: If you’re managing multiple consulting firms under MSAs, track who’s actually delivering against agreed terms. MSA governance reviews should be part of your annual supplier check-ins—just like you’d do in manufacturing or IT.

⚠️ Watchouts: Rates, Rebates & Red Flags

Let’s address a trap we’ve seen too often: celebrating rock-bottom daily rates as a negotiation win.

Spoiler: that’s not a win—it’s a warning.

Consultants can’t invoice less than what they pay their people. If you’re getting ultra-low rates, you’re probably not getting the A-team. You’re getting the C-team—or freelancers with a loose connection to the firm.

Remember:

- A low rate on paper doesn’t mean low cost if the project drags.

- Cheap consultants can cost you more in rework, hand-holding, or missed outcomes.

- And that “senior partner” in the proposal? He might never touch your project.

So yes, use MSAs to negotiate rates—but also use them to set expectations around staffing. Who’s doing the work? What’s the minimum level of experience? What does “success” look like?

And when rebates are part of the deal, great—but don’t let that be your only lever. Quality, speed, and business impact matter just as much.

✅ Your Panel & MSA Checklist

| What To Do | What To Avoid |

| Segment suppliers by capability and region | Relying solely on big brand names |

| Set clear MSA templates for recurring firms | Rewriting contracts every project |

| Monitor actual usage vs. panel targets | Over-concentrating spend unintentionally |

| Clarify staffing expectations | Celebrating “lowest bidder” wins |

| Include performance reviews in your governance | Letting underperformers stay because “they’re on the panel” |

Panels and MSAs aren’t just procurement tools—they’re strategic enablers. Use them to reduce friction, increase flexibility, and bring structure without killing creativity.

Because in consulting, structure isn’t the enemy of innovation—it’s the foundation for it.

Tail Spend in Consulting: Managing the Hidden Beast

Let’s talk about that sneaky little creature lurking in your consulting budget: tail spend. It’s like the dust bunnies under your bed—easy to ignore but accumulating faster than you’d expect. And just like those dust bunnies, if you don’t manage tail spend, it can lead to a cluttered and inefficient environment.

What Does Tail Spend Look Like in Consulting?

Tail spend refers to the myriad of small, often unmonitored consulting engagements scattered across various departments. Individually, these projects might seem insignificant, but collectively, they can account for up to 25% of your total consulting expenditure.

Imagine each department hiring consultants for minor projects without a centralized oversight. One team brings in a consultant for a quick market analysis; another hires someone for a brief training session. Before you know it, you’ve got a fragmented landscape of consulting engagements, each flying under the procurement radar. To better manage this hidden spend, explore our insight on tail spend.

Identifying Fragmented Usage and Duplication

This decentralized approach often leads to:

- Redundancy: Multiple departments unknowingly engaging different consultants for similar tasks.

- Inconsistent Quality: Varying standards and outcomes due to the lack of a unified vetting process.

- Missed Savings: Losing out on volume discounts or favorable terms that come with consolidated spending.

To spot these issues:

- Conduct a Spend Analysis: Dive into your consulting expenditures to identify patterns, redundancies, and opportunities for consolidation.

- Engage Stakeholders: Collaborate with department heads and project managers to understand their consulting needs and past engagements.

- Implement a Centralized Tracking System: Use digital tools to monitor and manage consulting engagements across the organization, ensuring transparency and control.

Leveraging 2nd & 3rd Tier Providers Effectively

Not every project requires a top-tier consulting firm. In fact, smaller, specialized consultancies can offer:

- Cost Efficiency: Lower overheads often translate to more competitive rates.

- Niche Expertise: Specialized firms may possess deep knowledge in specific areas that larger firms might not focus on.

- Flexibility: Smaller firms can often adapt more quickly to your organization’s unique needs.

To make the most of these providers:

- Build a Preferred Supplier List: Curate a roster of vetted 2nd and 3rd tier consultancies tailored to various project types and budgets.

- Set Clear Engagement Guidelines: Define when and how to engage these providers, ensuring alignment with organizational standards and objectives.

- Monitor Performance: Regularly assess the outcomes of engagements with these firms to ensure they meet your expectations and deliver value.

Balancing Control with Flexibility

Managing tail spend doesn’t mean stripping departments of their autonomy. Instead, it’s about creating a framework that allows for flexibility while maintaining oversight. Consider:

- Establishing Thresholds: Set budgetary limits under which departments can independently engage consultants, with anything above requiring procurement involvement.

- Providing Training: Equip department leads with the knowledge to make informed decisions about when and whom to engage for consulting services.

- Regular Reviews: Schedule periodic assessments of consulting engagements to ensure alignment with organizational goals and to identify areas for improvement.

By shining a light on tail spend and implementing strategic measures, you can transform this ‘hidden beast’ from a lurking liability into a managed asset, driving efficiency and value across your consulting engagements.

For a deeper dive into managing tail spend in consulting, check out this comprehensive guide: How to Manage Tail Spend in Consulting?

Supplier Performance: Evaluation at the Partner Level

When it comes to consulting, it’s easy to be dazzled by big-brand names. But here’s the reality: the success of your project often hinges more on the individual consultant leading the charge than the firm’s logo on the door. That charismatic partner who pitched you the vision? They might be MIA once the ink dries, leaving you with a team that doesn’t quite measure up.

Why Partner-Level Performance Matters More Than Brand

Let’s set the record straight: in consulting, it’s not the firm that delivers the project—it’s the partner.

Sure, the firm might win the pitch. But it’s the individual partner or project manager who’s responsible for understanding your business, mobilizing the right team, making smart decisions on the fly, and ultimately delivering value.

And here’s the kicker: not all partners are created equal. Even within the same firm, capabilities can vary dramatically.

We’ve seen it firsthand:

- One partner might be a genius in operations but hopeless in strategy.

- Another may be excellent with client relationships but struggle with delivery rigor.

- And yet, when you evaluate performance only at the firm level… you miss all that nuance.

This is why assessing supplier performance only by brand is misleading. You’re not buying a brand—you’re buying the leadership, experience, and judgment of specific individuals.

If you don’t track that? You’re essentially playing Russian roulette with your consulting spend.

Frameworks and Metrics for Evaluating Consulting Performance

So, how do you ensure you’re getting the A-team? Implementing a robust performance evaluation framework is key. Here’s a roadmap:

- Define Clear Objectives and Key Performance Indicators (KPIs):

- Set specific, measurable goals for the project.

- Establish KPIs that align with these objectives, such as project milestones, budget adherence, and quality of deliverables.

- Regular Progress Assessments:

- Schedule periodic reviews to track progress against KPIs.

- Address any deviations promptly to keep the project on course.

- Post-Project Evaluation:

- Conduct a comprehensive review upon project completion.

- Analyze successes, areas for improvement, and overall consultant performance.

By systematically applying these steps, you create a culture of accountability and continuous improvement.

Collecting Qualitative and Quantitative Feedback

Numbers tell part of the story, but qualitative insights fill in the gaps. To get a holistic view:

- Surveys and Interviews:

- Gather feedback from team members who interacted with the consultants.

- Focus on communication skills, adaptability, and cultural fit.

- Performance Reviews:

- Evaluate the consultant’s ability to meet deadlines, quality of work, and responsiveness.

- 360-Degree Feedback:

- Collect insights from all levels of your organization to understand the consultant’s impact comprehensively.

Combining hard data with personal experiences provides a nuanced understanding of consultant effectiveness.

Building a Culture of Continuous Improvement

Regular performance evaluations aren’t just about accountability—they’re about growth. By consistently assessing consultant performance, you:Consulting Quest

- Ensure alignment with your company’s evolving goals.Consource

- Foster stronger partnerships based on mutual respect and understanding.Consource

- Optimize your consulting spend by investing in relationships that deliver tangible value.Consource+1Consource+1

Remember, a consulting firm’s reputation sets the stage, but it’s the individual consultants who deliver the performance. By focusing on partner-level evaluation, you’re not just hoping for success—you’re planning for it.

For a deeper dive into measuring consultant performance, check out this comprehensive guide: Measuring Consultant Performance: Because Guesswork Isn’t a Business Strategy

The Human Factor: Why Consulting Is Always Human to Human

At its core, consulting is a business of trust.

And trust, by its very nature, is human.

When you engage consultants, you’re not just buying methodologies, frameworks, or PowerPoint decks—you’re entering a relationship. A relationship that has two parallel tracks:

- The Intrapersonal Relationship: between your internal stakeholders and their “trusted” consultants—the individuals they call, brainstorm with, and rely on when things get tough.

- The Institutional Relationship: between your organization and the consulting firm—managed through contracts, panels, governance structures, and executive sponsorships.

Both layers are important.

Both need to be nurtured carefully.

Neglect the human connection, and even the best contract won’t save a failing project.

Neglect the institutional structure, and even the best relationships will eventually drift.

Trust Goes Both Ways

It’s tempting to think that procurement’s role is purely about controlling spend or managing suppliers. But in consulting, you must become a builder of trust—internally and externally.

Stakeholders must trust:

- That you’ll support their needs, not slow them down.

- That the consultants you bring in are capable, aligned, and credible.

Consultants must trust:

- That their efforts will be fairly evaluated.

- That good work leads to more opportunities, not just tighter negotiations.

Without mutual trust, value creation collapses.

Talent: You’re Not Buying a Brand—You’re Buying Brains

Consultants don’t sell widgets.

They sell time, expertise, judgment, and creativity.

Which means that who actually shows up to do the work matters just as much—if not more—than the brand name on the cover slide.

A big logo on the proposal might impress at first glance.

But when the rubber meets the road, it’s the team—the people—who deliver or disappoint.

Key to remember:

- Vet individual consultants, not just firms. Ask about actual project teams early.

- Insist on transparency. Review and approve project staffing plans.

- Track consultant performance at the individual level. Build internal profiles over time—know your “A-players.”

Great consulting outcomes are 80% about the team, 20% about the brand.

Never confuse reputation with readiness.

Knowledge Transfer: Consultants Should Work Themselves Out of a Job

The goal of any consulting project isn’t just to deliver a report.

It’s to leave your organization stronger.

And yet—let’s be honest—consulting firms are incentivized to stay embedded. Longer contracts, more workstreams, bigger billings.

That’s why you must force knowledge transfer deliberately.

It won’t happen naturally unless you design for it.

Build Knowledge Transfer into Your Projects:

- Define clear deliverables: Not just deliverables for you—but deliverables to you. (Training sessions, playbooks, frameworks, skills workshops.)

- Include transfer milestones in SOWs: Make it part of how success is measured.

- Create ramp-down plans: Ensure every major engagement has a built-in handover phase.

If the consultants leave, and you feel weaker—not stronger—you didn’t manage the project right.

Consulting Without Human Focus is Just Transactional Sourcing

You can’t manage consulting like you’re buying laptops.

This is a people business, fueled by trust, talent, and knowledge.

When you manage both the human side and the institutional side well, consulting transforms from a cost center into a true engine of strategic advantage.

Benchmarking Consulting Pricing: Why Averages Are Dangerous

When it comes to consulting pricing, benchmarking is essential—but it’s also dangerously easy to do wrong.

At a high level, there are two types of benchmarks you can use:

1. Internal Benchmarks

If your organization is large enough, you may have sufficient historical data to compare:

- What you paid for similar projects in the past

- What different business units are paying for similar scopes

- How your negotiated discounts have evolved over time

The limitation?

If your organization is not particularly mature in buying consulting services, your internal benchmarks will simply reflect your past mistakes. Poor sourcing practices, favoritism, and inconsistent scopes can all pollute your pricing data.

Put simply:

Bad buying habits = bad benchmarks.

Internal benchmarks are useful for identifying relative progress inside your company, but not for establishing what good market practice truly looks like.

2. External Benchmarks

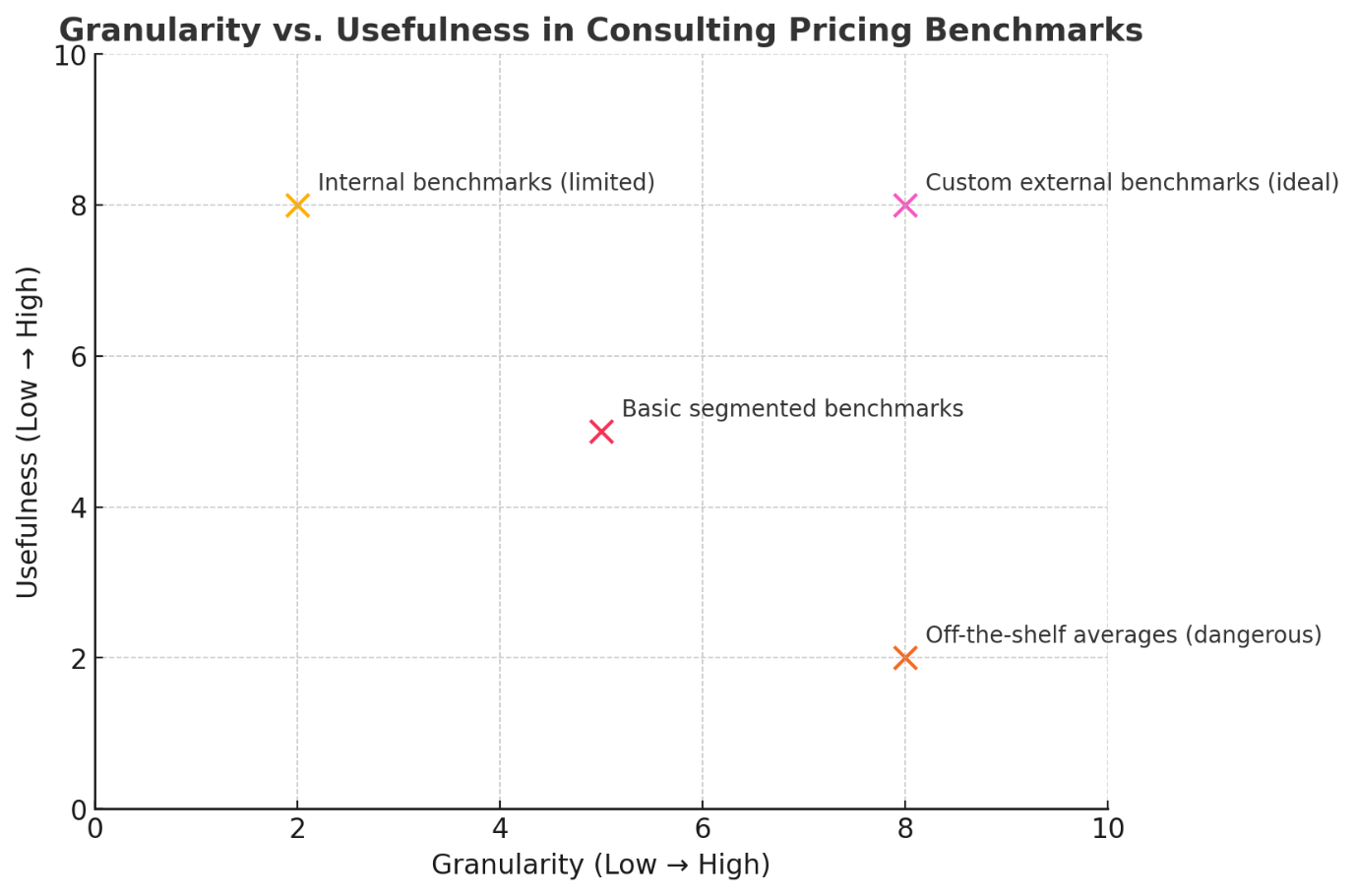

External benchmarks bring valuable market context—but they come with their own traps.

Most off-the-shelf consulting benchmarks oversimplify:

- They lump vastly different services under broad labels like “Strategy Consulting” or “Operations Consulting.”

- They flatten price differences across geographies, industries, and project types.

At Consulting Quest, we know better.

Our consulting taxonomy has:

- 8 major categories

- 24 sub-categories

- Over 100 detailed Level-3 categories

👉 Not saying you always need that much granularity.

But if you ignore key differences, averages become meaningless.

Example:

- A Tier-1 Strategy Firm typically charges ~4500€/day.

- A Tier-3 Operational Excellence Boutique might charge ~1700€/day.

They are not doing the same work.

They don’t deliver the same types of outcomes.

So why would you ever blend them into one “average rate”?

You must dig deeper.

Key Dimensions for Meaningful Pricing Benchmarks

A credible consulting benchmark must account for:

| Dimension | Why It Matters |

| Consulting Tier | Tier-1, Tier-2, Boutique — wildly different pricing structures |

| Service Line | Strategy, Operations, IT Implementation, HR, etc. — different value models |

| Geography | US pricing is typically 20% higher than Europe; Middle East can be 20–30% higher too |

| Industry | Banking and Pharma typically pay more than Chemicals, Manufacturing, or Energy |

| Project Type and Size | Small advisory vs. large transformation projects have very different cost drivers |

| Discounts and Volume Agreements | Real-world pricing isn’t just about sticker rates—it’s about negotiated terms |

| Staffing Models | Seniority mix dramatically impacts final cost per project |

Reminder:

Daily rates are only one piece of the puzzle.

What really matters is project structure:

- Duration

- Staffing model

- Discount structures

- Fixed fees vs. T&M

Granularity and relevance are critical when benchmarking consulting prices. Generic averages offer limited insight and can mislead sourcing decisions, while customized, detailed benchmarks provide strategic clarity and drive real value.

What Good Benchmarking Looks Like

Use broad market data to build annual pricing indices and track macro trends.

Use tailored, detailed benchmarks when sourcing specific projects.

When building granular benchmarks:

- Segment your consulting projects properly.

- Compare apples to apples.

- Adjust for region, industry, and scope complexity.

- Analyze not just how much you pay per day, but how projects are structured (duration, staffing, deliverables).

A good benchmark will help you predict, challenge suppliers effectively, and optimize both cost and value — without falling into the “average trap.”

Price Is Not Just a Number—It’s a Strategic Signal

When you understand consulting pricing deeply, you don’t just negotiate better rates.

You make smarter decisions about where to spend, how to structure work, and which suppliers deliver true value at the right price point.

Because in consulting, how you buy is just as important as what you buy.

Supplier Relationship Management (SRM) in Consulting

In consulting procurement, selecting the right supplier is only the beginning.

Sustaining value over time requires a deliberate, structured approach to managing consulting relationships—what we call Supplier Relationship Management (SRM).

But SRM in consulting isn’t the same as SRM for commodities or traditional services.

Consulting is a human-driven, transformation-focused service, and it demands an adapted, smarter management model.

SRM Adapted for Consulting Services

At Consulting Quest and through Consource, we’ve built SRM methodologies specifically tailored to consulting’s unique dynamics.

Effective SRM for consulting focuses on three pillars:

- Alignment with business strategy (consultants working on what truly matters)

- Performance and impact measurement (beyond satisfaction surveys)

- Continuous collaboration and communication (because conditions, scopes, and priorities evolve)

👉 SRM must be dynamic, not static.

It’s not about monitoring KPIs once a year—it’s about maintaining strategic, two-way dialogues with your key consulting partners.

Performance Reviews and Feedback Loops

Evaluating consulting performance isn’t just about ticking boxes.

It’s about asking the right questions:

- Did the project deliver measurable impact?

- Was knowledge transferred effectively?

- Was the team fit-for-purpose, and did staffing remain consistent?

- How was stakeholder satisfaction—not just at project start, but at project end?

- Were budgets, timelines, and quality expectations met?

Using tools like Consource’s performance analysis modules, you can track:

- Real project outcomes (not just activities)

- Stakeholder feedback scores

- Consultant partner-level performance (not just firm-level)

📈 Performance data feeds future sourcing decisions—who gets repeat work, who gets challenged, and who gets re-evaluated.

Regular Alignment and Communication Routines

Consulting SRM isn’t once-a-year housekeeping.

It’s a strategic rhythm of alignment and communication.

Best-in-class practices include:

- Quarterly Strategic Reviews (with top suppliers)

- Mid-project check-ins (not just post-mortems)

- Annual Joint Planning Sessions to anticipate transformation needs

- Systematic feedback collection at project milestones

Through platforms like Consource, you can structure and automate many of these processes—making relationship management systematic, efficient, and insight-driven.

Rule of thumb:

If your consultants only hear from you at contract negotiation or renewal time—you don’t have SRM, you have transaction management.

Treat Consultants Like Strategic Partners, Not Vendors

Consulting firms that feel engaged, valued, and accountable perform better.

They invest more senior attention, bring their best people, innovate solutions, and align closer with your goals.

A structured SRM approach:

- Strengthens trust

- Improves project outcomes

- Optimizes supplier fit over time

- Reduces switching costs and value leakage

Because in consulting, long-term strategic partnerships, managed the right way, will always outperform one-off tactical sourcing.

Frequently Asked Questions (FAQs) on Consulting Category Management

Managing consulting effectively often raises new questions for even the most experienced procurement teams. Here are answers to some of the most critical issues we encounter when helping organizations optimize their consulting spend.

Q1. Should consulting always be competitively sourced?

Yes — consulting projects should be competitively sourced as the default.

Competition drives better value, transparency, and strategic alignment.

Exceptions apply only in specific cases:

- Urgent needs requiring immediate action

- Niche expertise where only a few firms are qualified

- Continuation phases where supplier switching would destroy project continuity

Guideline: Default to competition. Use exceptions carefully, with clear governance.

Q2. How can procurement drive better collaboration with internal stakeholders?

By becoming an enabler, not a gatekeeper.

- Engage stakeholders early, during project scoping.

- Bring valuable insights on market capabilities and best practices.

- Help frame consulting as a tool to achieve business goals—not just a cost to control.

Build trust first. Governance will follow.

Q3. What is the most common mistake organizations make in managing consulting procurement?

Treating consulting like traditional indirect spend.

Consulting is not office supplies or IT licenses. It’s a people-driven, transformation-critical service.

Biggest pitfalls include:

- Over-focusing on day rates instead of value

- Ignoring the importance of the individual consultants (not just the firm)

- Neglecting to measure business outcomes

Consulting requires a category strategy adapted to its unique nature.

Q4. How often should we refresh our consulting supplier panel?

At least annually for light refreshes, and every 2–3 years for full strategic reviews.

The consulting market evolves fast: new firms emerge, mergers happen, capabilities shift.

Failing to refresh panels leads to:

- Stale capabilities

- Missed innovation opportunities

- Pricing inefficiencies

Panel management is not “set and forget”—it’s a dynamic, living strategy.

Q5. How should consulting project success be evaluated beyond budget and timeline?

A comprehensive evaluation must look at:

- Business impact: Tangible results achieved

- Knowledge transfer: Internal capabilities strengthened

- Stakeholder satisfaction: Beyond project sponsors

- Delivery discipline: Budget, scope, and quality adherence

At Consulting Quest and Consource, we recommend combining quantitative KPIs with structured qualitative feedback loops for every major engagement.

Q6. Are external consulting pricing benchmarks reliable for sourcing decisions?

Yes, but only when detailed and properly segmented.

Off-the-shelf averages are useful for tracking general trends—not for making project-level decisions.

A meaningful benchmark must account for:

- Consulting tier and brand positioning

- Service line specialization

- Geography and industry differences

- Project scope, size, and staffing model

Without segmentation, pricing benchmarks risk being dangerously misleading.

Taming the Wild West — One Category at a Time

Managing consulting spend often feels like facing a mythical creature.

Some companies treat consulting like a commodity—easy to price, easy to source.

Others treat it like a legendary monster—too complex, too delicate, impossible to tame.

In both cases, they are wrong.

Consulting isn’t a commodity—and it isn’t a unicorn either.

It’s a strategic lever. A transformation catalyst. And yes, it’s absolutely manageable—with the right approach.

The truth is simple:

Good old category management principles do apply to consulting—just with a twist.

- You need to understand the human side as much as the contractual side.

- You need to think in terms of outcomes, not just day rates.

- You need to balance internal stakeholder satisfaction with cost control.

- You need to track not just spend—but ROI.

Follow the strategies outlined in this guide, and you’ll bring clarity, control, and strategic impact to your consulting category.

You’ll move from opaque spend to visible value—from frustration to real performance.

And if you need help along the way—whether to professionalize your teams, design better playbooks, or improve your ways of working—

we’re here to help.

At Consulting Quest and through Consource, we’ve helped hundreds of organizations around the world turn consulting procurement into a true engine of value.

We’d be happy to help you do the same.

🚀 Ready to tame your consulting category? Let’s start the journey together.