Table des matières

Consulting has long defied traditional procurement playbooks. High-impact, high-visibility, but often low-transparency, it’s a category that has resisted the rigor applied to IT, logistics, or marketing. Until now.

As organizations face mounting pressure to do more with less—and to prove that every dollar spent drives meaningful impact—consulting spend analysis has become a strategic imperative.

It’s not just about cost control. It’s about insight. Visibility. Alignment. And ultimately, performance.

Done well, consulting spend analysis gives procurement the tools to finally treat consulting as a true category—applying segmentation, performance tracking, and supplier strategy to a domain that once felt out of reach.

It equips finance teams to move beyond cost centers and maverick spending, enabling better forecasting, cleaner baselines, and fact-based budget decisions.

And for strategy leaders, it shines a light on whether consulting is truly advancing transformation—or quietly funding initiatives that are more about comfort than change.

This guide is your blueprint. Whether you’re trying to optimize spend, build a robust category strategy, tame the tail, or simply ensure that every project supports your strategic agenda, you’ll find practical tools and frameworks to make consulting spend a lever for value—not just a line item.

Let’s dive in.

1. What Is Consulting Spend Analysis—and Why It Matters

Spend analysis isn’t new—but in the world of consulting, it takes on a different level of complexity. You’re not tracking widgets or transportation costs. You’re dealing with intangible services, loosely scoped projects, and a wide array of stakeholders with vastly different expectations. And unlike most indirect spend categories, consulting often blends operational execution with strategic ambition.

So, what exactly is analyse des dépenses de conseil?

At its core, it’s the structured process of examining how your organization engages with consulting firms—how much you spend, who is spending it, with whom, on what, and why. But beyond the basics, it’s a strategic tool to assess value, manage risk, and drive better decisions at the intersection of sourcing, strategy, and performance.

Why It’s Harder Than It Looks

Most organizations struggle to get an accurate view of their consulting spend. Why? Because consulting often hides in plain sight. It’s embedded in “professional services” codes, scattered across divisions, or sliced into sub-threshold projects to bypass approval workflows. There’s no product SKU, no fixed unit price, and no central gatekeeper.

The result? Decision-makers often make choices without a full view of supplier performance, spend patterns, or the strategic relevance of each project.

A strong consulting spend analysis changes that. It replaces gut feel with data, and scattered assumptions with structured visibility.

Top-Down vs. Bottom-Up: Two Ways to Analyze Your Spend

There are two primary approaches to analyzing consulting spend—each with its own strengths:

- Top-Down Analysis:

This starts with high-level data—overall spend per business unit or category—and looks for broad patterns and anomalies. It’s faster, easier to implement, and useful for spotting trends and identifying outliers. - Bottom-Up Analysis:

This method goes granular—tracking spend project by project, invoice by invoice. It requires more effort, but yields sharper insights: duplicate projects, hidden strategic work, underperforming suppliers, and pricing inconsistencies.

In most cases, the sweet spot lies in combining both: starting top-down to prioritize where to look, then zooming in bottom-up to validate and act.

The Value It Unlocks

Whether you’re managing €5M or €50M in consulting services, spend analysis creates leverage—financial, operational, and strategic:

- Financial: Identify overspending, duplicates, or bloated panels. Use data to negotiate better rates and reallocate budget more effectively.

- Opérationnel: Reduce fragmentation, improve internal governance, and establish sourcing protocols based on project segmentation.

- Strategic: Ensure your consulting investments align with your transformation agenda—not just internal comfort zones or legacy relationships.

In short, consulting spend analysis is the foundation for better consulting procurement. It gives you the data, structure, and insight to control spend, elevate performance, and make sure your investments are truly moving the needle.

2. Strategic, Tail, False, and Misclassified Spend—What Are You Really Buying?

Not all consulting spend is created equal—and not all of it is even consulting.

One of the most critical steps in analyzing your consulting spend is understanding what types of projects you’re really paying for. By segmenting spend into strategic, tail, false tail, et misclassified categories, you gain the clarity needed to prioritize sourcing strategies, drive savings, and align spend with business goals.

Let’s explore each category in depth.

#1: Strategic Spend – High Value, High Stakes

Strategic spend represents the lion’s share of both impact and budget. These are high-priority, often recurring projects aligned with your organization’s transformation goals—think growth strategy, digital innovation, or operational turnaround.

What defines strategic spend isn’t just size—it’s relevance. Strategic projects:

- Are usually sponsored at the executive level.

- Require rare or high-value capabilities.

- Align directly with long-term strategic objectives.

- Often involve Tier-1 or deeply specialized consulting firms.

Some strategic initiatives, like corporate strategy or post-merger integration, clearly fall into this category. But beware: even within strategic projects, there may be components that could be managed more efficiently, such as training, project support, or communication work—areas that might be better suited for internal teams or specialist providers.

#2: Tail Spend – Small, Fragmented, and Unmanaged

Tail spend typically refers to the final 20% of spend that involves 80% of your suppliers—often low-value, one-off, or fragmented projects that escape procurement oversight.

Key characteristics of tail spend:

- Small project sizes, often below procurement thresholds.

- Sourced informally or outside centralized processes.

- Frequently repetitive or duplicative.

- Difficult to monitor, track, or consolidate.

Though it might seem insignificant, tail spend is often a goldmine for cost optimization. Many companies discover recurring coaching programs, lean workshops, or change management initiatives scattered across departments—with little coordination and massive overlap.

By identifying and grouping these tail projects, organizations can consolidate needs, reduce supplier count, and negotiate better rates through framework contracts or preferred panels. (Learn more about how to manage tail spend in consulting ici.)

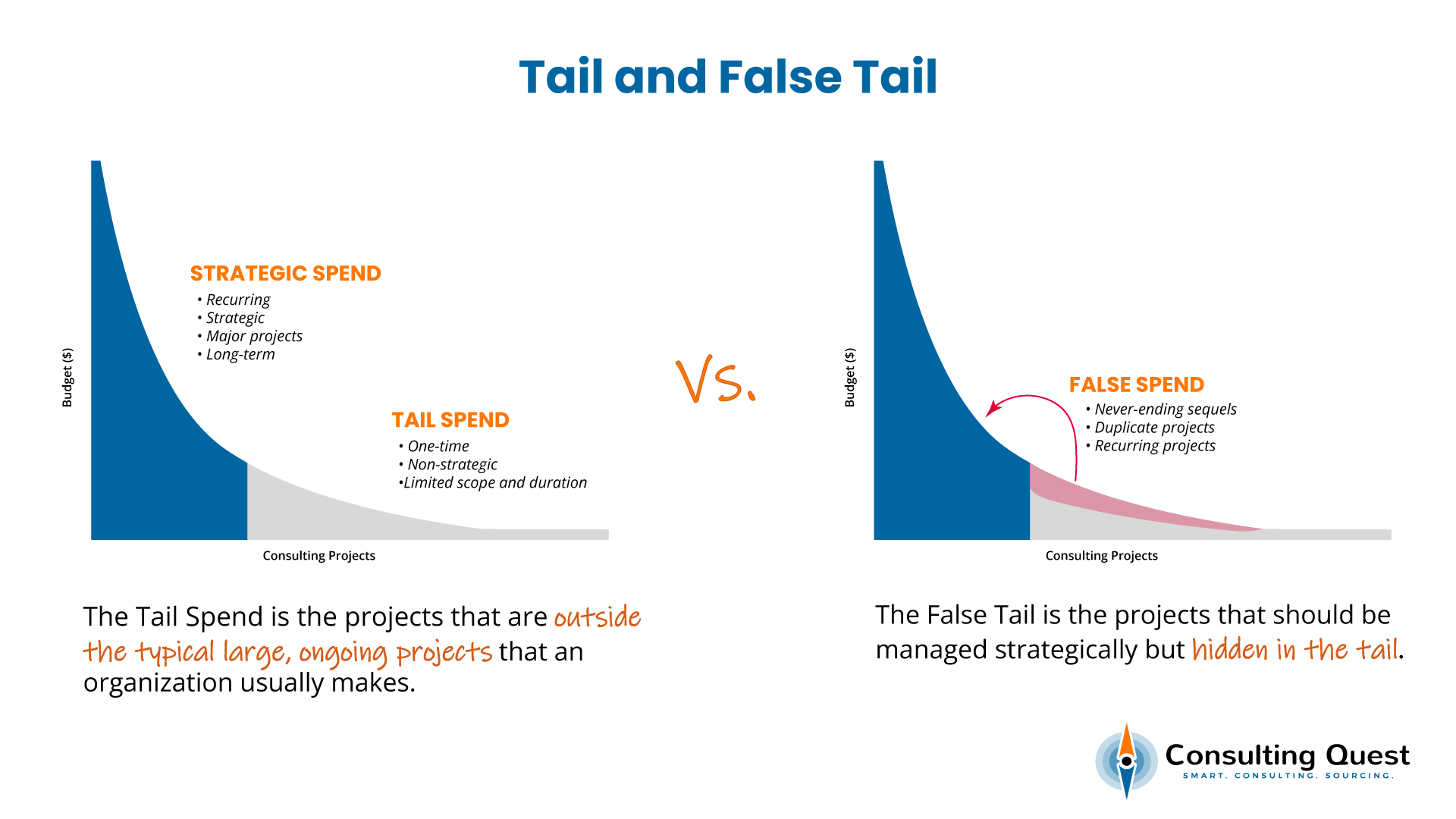

#3: False Tail – Strategic Projects Hiding in the Tail

Some projects that appear to belong in the tail are, in fact, strategic in disguise.

We call this false tail spend—small-scope projects that, when aggregated, represent significant investment and importance. Sometimes, the budget is deliberately split to avoid thresholds or governance hurdles. Other times, it’s the result of poor visibility or decentralized decision-making.

Common red flags include:

- Repeated engagements with the same consultant just below the approval limit.

- Large projects sliced into micro-phases to expedite purchasing.

- Tactical continuations of previous strategic initiatives (“sequels”) without reassessment.

A typical example? A consulting firm invoices €49,950 three times a year when the procurement threshold is €50,000. On paper, it’s tail spend. In reality, it’s a single, large engagement disguised as something else.

False tail is dangerous: it evades scrutiny, bypasses competitive sourcing, and inflates total cost. Identifying it requires bottom-up project analysis and clear spend thresholds aligned with project segmentation logic.

#4: Misclassified Spend – When It’s Not Even Consulting

Finally, there’s a category that few talk about—but everyone has: non-consulting spend hidden in the consulting bucket.

Consulting, due to its ambiguous scope and typically lower procurement oversight, often becomes a “buffer budget”—a convenient place to park activities that don’t belong anywhere else.

Examples of misclassified consulting spend:

- Contracting engineering design or IT development work through a consulting PO.

- Funding training, software licenses, or internal workshops as “advisory support.”

- Hiding unbudgeted initiatives in strategy envelopes to avoid scrutiny.

- Using consulting budgets to indirectly fund headcount or staff augmentation.

In one case, a company discovered that over 15% of its consulting spend had nothing to do with consulting—it was catering, software, or contractor fees bundled into ambiguous scopes of work.

This misclassification not only skews spend analysis, but corrupts performance metrics, creates governance risks, and weakens credibility in the boardroom. Cleaning this up is essential for building a strong baseline and making real strategic decisions.

Why This Classification Matters

Breaking your spend into these four buckets—Strategic, Tail, False Tail, et Misclassified—isn’t academic. It’s actionable.

It allows you to:

- Target your sourcing strategy: High-value, high-complexity projects demand rigor. Low-value, recurring ones call for bundling.

- Focus your governance: Not everything needs the same process. This segmentation helps apply the right level of scrutiny to each type of project.

- Spot the leaks: Whether it’s overpaying for repetitive work or hiding services under the radar, this lens helps you close the gaps.

Most importantly, it gives you a structured language to talk about your consulting spend—with stakeholders, leadership, and suppliers alike.

3. The Consulting Performance Scanner: A Proven Framework

To move from observation to action, you need more than raw data. You need structure. That’s why we developed the Consulting Performance Scanner—a comprehensive diagnostic tool that gives you a 360° view of your consulting activities.

This framework examines your consulting spend across three dimensions:

- What, how much, and who is spending

- How decisions are made

- What value is created

By analyzing these three layers together, you gain the visibility needed to streamline sourcing, enforce governance, and capture real performance insights.

Dimension 1: What, How Much, and Who Is Spending

The first layer answers the fundamental questions:

Where is your money going? Who is spending it? On what kinds of projects?

| Data to Collect | Sources | Key Outputs |

| Total consulting spend | Invoices, POs | Overall spend, spend vs. revenue ratio |

| Spend by business unit/function | ERP data, department budgets | BU-level spend profiles |

| Project types and capabilities | SOWs, RFPs, proposals | Capability heatmaps, capability gaps |

| Supplier data | Contracts, vendor master list | Top suppliers, panel concentration, specialization levels |

| Project duration and frequency | Timesheets, proposals, delivery plans | Project recurrence, seasonality trends |

👉 Pourquoi est-ce important: This creates your baseline. Without this level of detail, you can’t manage, negotiate, or improve your consulting category with confidence.

Dimension 2: How Consulting Decisions Are Made

Now that you know what’s being spent, you need to understand how and why those projects were initiated.

| Decision Point | Questions to Ask | Data Sources |

| Project rationale | Why was consulting selected for this work? | Internal interviews, project briefs |

| Decision-making process | Who approved it? What were the validation steps? | Workflow tools, approval chains |

| Procurement involvement | Was sourcing competitive? Was procurement engaged early or late? | RFx records, internal feedback |

| Governance thresholds | Are there spend levels that bypass oversight? | Procurement policy, audit logs |

| Stakeholder engagement | Who are the sponsors, approvers, and budget owners? | Org charts, budget records |

👉 Pourquoi est-ce important: Many inefficiencies stem not from what’s bought—but how it’s bought. Mapping your internal process reveals gaps in governance, misalignment, and missed opportunities for leverage.

Dimension 3: What Value Are You Getting?

The final layer focuses on outcomes. Because great scoping and sourcing don’t matter if the project doesn’t deliver.

| Evaluation Criteria | Questions to Explore | Sources |

| Supplier performance | Did the consulting firm deliver on time, on budget, and to expectations? | Post-project surveys, NPS, reports |

| Expertise and engagement quality | Was the team skilled, collaborative, and business-savvy? | Internal feedback, project debriefs |

| ROI and strategic contribution | Did the project generate measurable results? | KPIs, financials, stakeholder input |

| Fit for future work | Would you rehire this firm for a similar or different assignment? | Project sponsor feedback |

| Comparison across suppliers or BUs | Are there performance trends by firm, region, or capability? | Consolidated scorecards |

👉 Pourquoi est-ce important: Spend visibility tells you where your money goes. Performance data tells you if it was worth it.

Putting It All Together

The true power of the Performance Scanner lies in combining all three dimensions:

- You know how much you’re spending (and with whom).

- You understand how those choices are made (and where the process breaks).

- You measure what you’re getting in return (and how to raise the bar).

Armed with this view, you can:

- Identify high- and low-performing suppliers.

- Adjust your sourcing strategy by capability or geography.

- Drive continuous improvement in how you buy—and use—consulting.

In many cases, this insight alone unlocks quick wins, such as renegotiating underperforming contracts or phasing out low-ROI suppliers.

4. Transform Data into Value: From Diagnosis to Action

Collecting the data is just the beginning. Real value starts when you use that data to make smarter, faster, and more impactful decisions.

A robust consulting spend analysis should unlock more than reports—it should become your decision engine. But here’s the twist: you don’t need perfect data to start. In fact, many of our clients begin the journey with fragmented ERP systems, incomplete PO descriptions, and minimal project tagging.

The good news? Even high-level data can fuel game-changing insights.

A. You Don’t Need Perfect Data to Drive Real Impact

Don’t let a lack of granularity paralyze you. If you can access the basics—supplier names, departments, total spend—you already have what you need to start spotting opportunities.

| Minimal Input | Insights You Can Still Uncover |

| Supplier name | Identify panel redundancy or over-reliance on single vendors |

| Spend amount | Flag departments with outsized or inconsistent spend |

| Department or BU | Reveal concentration, tail patterns, and decentralized sourcing behaviors |

| Frequency | Expose duplicates, sequels, or evergreen engagements |

Once the picture begins to form, you can build momentum—and buy-in—for deeper analysis and governance improvements.

B. Slice, Dice, and Tackle the Outliers

Now that the data is in hand, the key is pattern recognition. Outliers and inconsistencies are often your quickest wins.

Here are classic examples we see in client portfolios:

One Business Unit Spends More Than Others

Don’t jump to conclusions. It’s not always a red flag. What matters is value creation, not spend level. But it’s worth asking: Is the spend justified? Are projects delivering ROI? Or is this an unmonitored comfort zone?

A Consulting Firm Charges 40% More

Let’s say John Doe Consulting routinely charges 40% more than other firms for similar deliverables. Is it justified? Maybe. But maybe they’re inflating rates when working with Business Unit B—your most profitable and least scrutinized BU.

Supplier Performance Varies by Business Unit

Remember your old school days? You may have scored lower in Mrs. Jones’ class than in Mr. Bouchart’s—not because you were worse, but because the grading was tougher. Consulting performance ratings work the same way. Project sponsors have different expectations, management styles, and tolerance for ambiguity. That’s why it’s critical to gather feedback from both sponsors and project leads—and always compare like with like.

C. Don’t Forget the Internal Consulting Team

Most companies overlook their internal consulting capabilities in spend analysis.

That’s a mistake.

Your internal consulting group—often composed of ex-consultants—brings deep business knowledge and stakeholder trust. When included in the analysis, you can:

- Compare cost-effectiveness vs. external providers

- Identify capability gaps or underused potential

- Position the team more strategically in transformation roadmaps

Many clients discover that internal teams deliver similar impact at a lower cost—but get overlooked in favor of external brand names. Learn more about how to elevate your internal consulting group by visiting our insight on the topic.

D. Use Benchmarks to Add Context and Credibility

Raw numbers only tell part of the story. To elevate the conversation—and build internal alignment—external benchmarks are essential.

| Benchmark Area | Insight You Can Gain |

| Pricing (e.g., € per day/week) | Are you paying above market for similar capabilities? |

| Capability mix | Are you underinvesting in areas like sustainability or digital vs. peers? |

| Panel structure | Is your supplier ecosystem too concentrated—or too fragmented? |

| Procurement maturity | How advanced is your sourcing process vs. industry norms? |

At Consulting Quest, we use a cluster-based benchmarking model—comparing your data with companies of similar size, industry, and consulting maturity. This ensures you get relevant, tailored insights, not generic market averages. (Discover how consulting maturity plays a role in our approach ici.)

E. Start Turning Insight into Action

Here’s how you go from dashboard to decision-making:

- Tackle the Outliers

Investigate price discrepancies, recurring low-ROI projects, and underperforming suppliers. These quick wins often pay for your sourcing transformation. - Rationalize and Restructure Your Panel

Keep your best performers. Phase out the under-delivering firms. Add new players with capabilities aligned to your future needs. - Segment Demand to Match Strategy

Not every project is strategic. Set clear thresholds, sourcing models, and governance levels by capability and risk—not just by budget size. - Share the Story

Use data to show—not just tell—why changes are needed. Executive sponsors and operational buyers are far more likely to support reform when they see the numbers.

With this approach, spend analysis isn’t just an audit—it’s a launchpad. It helps procurement optimize, finance control, and strategy prioritize—so the entire organization can get more from every consulting dollar.

5. Managing the Tail: Your Hidden Goldmine

If your consulting spend were an iceberg, the tail would be what lurks below the waterline—fragmented, low-visibility, and quietly consuming a significant chunk of budget and time.

Tail spend often accounts for 20% of your total consulting budget but involves up to 80% of your suppliers. It includes one-off requests, short engagements, local contracts, and sometimes… things that aren’t really consulting at all.

Most importantly, tail spend is not random—it’s the direct consequence of decentralized governance and threshold-based autonomy.

Why the Tail Exists—and Why It Grows

Tail spend isn’t a procurement failure. It’s the outcome of systems designed for flexibility—systems like:

- Low-value thresholds that allow projects to bypass sourcing or approvals

- Local autonomy that empowers business units to “move fast” without central coordination

- Lack of segmentation where everything vaguely labeled “consulting” is treated the same

Without a structure to guide how these small projects are sourced, evaluated, or grouped, the result is a bloated, unmanaged tail.

What’s Really in the Tail

Once you map the data, patterns emerge. Tail spend isn’t just small—it’s often inefficient, redundant, and invisible.

| Tail Spend Type | Description |

| One-Off Projects | Short-term initiatives or diagnostics without follow-up |

| Recurring “Sequels” | Follow-ups to previous work done by the same supplier without re-scoping |

| Duplicates | The same topic addressed by different BUs using different firms |

| Staff Augmentation | Interim managers, analysts, or PMO support billed as “consulting” |

| Microservices | Coaching sessions, expert calls, or market data embedded in custom proposals |

Many of these projects are legitimate. But when they’re unmanaged, they become high-cost, low-ROI noise in your overall consulting portfolio.

The False Tail: Strategic Spend in Disguise

Even more dangerous than tail clutter is false tail spend—projects that look small but are strategically significant. These often:

- Fly under governance thresholds by slicing budgets (e.g., €49,950 when the limit is €50,000)

- Represent serial renewals of earlier engagements

- Include high-impact work that bypassed sourcing through loopholes

The false tail is not just inefficient—it’s a compliance and performance risk.

How to Fix the Tail Without Killing Agility

Let’s be clear: the solution is not more control. It’s better enablement.

The goal is to maintain operational agility while creating the structure, visibility, and supplier ecosystem to make better decisions—even on small projects.

Here’s how to do it:

✅ Define a Tail-Appropriate Panel Strategy

Don’t force tail projects through the same suppliers or process as strategic ones. Instead, build a parallel structure designed for speed, simplicity, and fit-for-purpose providers.

Options include:

- Consulting platforms (for access to pre-vetted freelancers and boutique firms)

- Expert networks (for fast insights, interviews, and Q&A)

- Market research subscriptions (to replace custom benchmarking)

- Framework agreements (for training, PMO, coaching, etc.)

This approach aligns sourcing with need—and avoids calling McKinsey for a one-day workshop.

✅ Use Digital Platforms to Channel the Tail

A platform like Consource makes tail management scalable:

- Centralized intake and project scoping

- Lightweight workflows for small engagements

- Smart routing to appropriate suppliers

- Embedded compliance rules and thresholds

- Real-time visibility across the organization

Instead of manually policing every €10,000 project, let the platform enforce consistency—without bureaucracy.

✅ Implement Guided Sourcing Workflows

Operational teams often don’t know where to start. Guided workflows help them:

- Define the real need (advice, delivery, insight?)

- Pick the right supplier type (platform, panel, expert?)

- Trigger appropriate governance (light or full)

This lowers rogue behavior, improves quality, and builds sourcing confidence at the edge of the organization.

✅ Segment, Monitor, and Educate

Managing the tail isn’t a one-time project. It requires ongoing segmentation and support.

- Segment tail projects by capability, region, and value.

- Track performance, even on micro-projects.

- Educate internal buyers on sourcing logic and supplier options.

- Debrief and review outcomes to refine panel fit and supplier trust.

The Payoff

When managed correctly, tail spend becomes:

- A source of agility, not a compliance nightmare

- A savings opportunity, through bundling and rerouting

- A performance lever, with consistent supplier evaluation

- An insight engine, showing you what the business really needs in real time

And when you tame the tail, you also free up procurement capacity to focus on more strategic initiatives—where the stakes (and the value) are higher.

6. From Spend to Strategy: Build a Better Consulting Category

Let’s be honest: consulting has long been procurement’s outlier. Too strategic to box in, too intangible to pin down, and too often managed on the fly. But that’s exactly why it deserves its own category strategy—one that reflects how complex, high-value, and business-critical consulting truly is.

The good news? You don’t need to reinvent category management. You just need to apply it intelligently to the unique structure of the consulting market.

Let’s look at what a robust consulting category strategy really entails—and why it starts with segmentation, thrives on taxonomy, and comes to life through your supplier panel.

A. Taxonomy First: Stop Managing Fog

If you can’t name it, you can’t manage it. That’s where taxonomy comes in.

Too many organizations group “consulting” into one vague bucket. The result? Strategic planning sits next to SAP configuration. You get benchmarked against nothing. And sourcing becomes a guessing game.

The solution isn’t to go ultra-granular and end up with a liste à la Prévert of consulting types you’ll never use. Nor is it to stay vague and generic. The answer lies in smart segmentation: detailed enough to drive insights, lean enough to manage.

Your taxonomy should reflect:

- Your actual spend profile (What do you really buy today?)

- Your future strategic priorities (What will you need tomorrow?)

- Le structure of the consulting market (How is the supply base organized?)

The goal? A clean, coherent map of your consulting category—one that’s usable by procurement, finance, and strategy alike.

B. Segment What You Buy (and Who You Buy From)

Consulting is not one market—it’s many. Your category strategy should reflect that.

Segment your demand along three key dimensions:

- Expertises (e.g., strategy, operations, HR, digital)

- Industries (e.g., healthcare, energy, financial services)

- Delivery Models (Tier-1 firms, boutiques, platforms, expert networks)

Why it matters:

- Different price points: A week of work in strategy is not the same as a week in lean ops.

- Different supplier ecosystems: Some segments are crowded and competitive; others are niche or underdeveloped.

- Different buying behaviors: Executive coaching isn’t sourced like a post-merger integration.

Your segmentation should lead to tailored sourcing strategies—not one-size-fits-all rules.

C. Your Supplier Panel: Where Strategy Becomes Reality

Here’s where it gets real. Once you’ve mapped your segments, it’s time to design your consulting panel—and this is where most companies get stuck.

The challenge? Balancing global consistency with local relevance.

- Global panels give you scale, brand equity, and commercial leverage with top-tier firms.

- Local panels offer agility, specialized expertise, and cultural fit—especially with mid-sized and boutique consultancies.

The smartest companies don’t choose—they blend.

A good consulting panel includes:

- Tier-1 players for high-visibility transformation and global projects

- Mid-sized firms for value-for-money execution and regional strength

- Specialist boutiques for niche expertise and technical depth

- Platforms and networks for flexible, just-in-time consulting

Your panel strategy should mirror your segmentation, giving business leaders options they trust—and procurement the structure it needs to drive value.

| Panel Layer | Best For |

| Global Tier-1 Firms | Strategic programs with C-level visibility, board involvement, or high stakes; projects requiring global coordination, structured methodologies, and brand assurance. |

| Regional Mid-Sized Firms | Operational or implementation projects with lower visibility; situations where cultural proximity, language, or industry expertise is critical; strong fit for country- or region-specific transformations. |

| Local/Niche Boutiques | Highly specialized expertise or technical depth; smaller, focused projects where scalability isn’t required; often lack visibility with executive leadership but bring hands-on value to line teams. |

| Platforms / Alternatives | Fast access to vetted talent for short, focused interventions; best for expert interviews, micro-consulting, diagnostics, or when continuity and team integration are not priorities. |

D. What Makes a Strong Category Strategy

At its core, a consulting category strategy should answer four simple questions:

- What are we really buying—and why? (taxonomy and segmentation)

- What does the supplier landscape look like—and how do we access it? (market structure)

- How do we balance value, cost, and flexibility? (sourcing model)

- How do we enable the business—without losing control? (governance and workflows)

This is where all the building blocks come together: demand planning, project segmentation, approval thresholds, supplier performance, panel management, and guided sourcing.

Done right, you move from tactical firefighting to strategic orchestration—from managing spend to shaping impact.

7. Empowering the Process with Digital Tools

If consulting spend is one of your most complex categories, why are you still managing it with spreadsheets and email threads?

Digital tools aren’t just about automation—they’re about intelligence. They give you the visibility and responsiveness you need to manage consulting spend like the strategic lever it is—not a mystery cost line.

In fact, the most powerful transformation digital tools offer isn’t efficiency. It’s foresight.

From Rear-View Analysis to Real-Time Visibility

Traditional spend analysis is retrospective. You pull data once a quarter—or once a year—by which time the money’s spent, the contracts are closed, and it’s too late to pivot.

Modern digital platforms give you:

- Real-time dashboards of engagements, spend, and pipeline

- Dynamic tracking of budgets, project status, and commitments

- Consolidated views across business units, geographies, and suppliers

This real-time lens is a game-changer. You don’t just see what happened. You see what’s happening now—and what’s about to happen.

Pour financer, this means no more last-minute surprises or runaway budgets.

Pour strategy teams, it means early signals when a transformation project goes off track—or when new requests don’t align with business priorities.

And for approvisionnement, it’s the key to running consulting like a mature, data-driven category.

The Missing Link in Category Management: Anticipation

Category strategies aren’t static. They need to evolve with your business.

But how can you adapt if you only get data quarterly—or rely on disconnected reports?

Digital tools bring your consulting category to life:

- Spot shifts in demand as they happen

- Adjust panels and sourcing approaches dynamically

- Identify changes in supplier performance early

- Optimize thresholds, workflows, or approval layers based on usage patterns

With real-time analytics and predictive insights, you can move from governance to guidance—supporting stakeholders while steering the overall strategy.

From Control to Collaboration

Too often, digital procurement systems are seen as compliance tools—rigid, restrictive, and disconnected from business reality.

But smart consulting platforms do the opposite. They empower both sides:

- Operational teams can scope projects, access pre-approved suppliers, and launch requests quickly.

- Procurement and category leaders maintain guardrails, insight, and performance visibility—without becoming bottlenecks.

This model brings transparency without friction. Everyone sees what’s happening. Everyone plays their role. You enable smart decisions without micromanaging.

Consource: Built for the Realities of Consulting

At Consulting Quest, we saw too many clients struggle to apply generic procurement tools to a category that defies standardization.

So we built Consource, an end-to-end consulting sourcing and performance platform that’s:

- Flexible enough for fast-moving strategy teams

- Structured enough for procurement governance

- Insightful enough for finance to anticipate risks

Consource integrates:

- Scoping tools

- Smart sourcing workflows

- Supplier panel access

- Real-time dashboards

- Performance management

- ROI and impact measurement

And because it’s purpose-built for consulting, it speaks your stakeholders’ language—not just procurement jargon.

What You Gain with the Right Digital Infrastructure

| Capability | Strategic Advantage |

| Real-Time Spend Visibility | Prevent overspend, reallocate budget proactively, track by BU or category |

| Pipeline Transparency | Anticipate sourcing needs and resource requirements |

| Guided Sourcing Workflows | Support stakeholders, reduce rogue spending, ensure fit-for-purpose choices |

| Embedded Governance | Enforce thresholds, approvals, and panel compliance |

| Performance Tracking | Spot supplier issues early, feed future decisions with real data |

| Centralized Intelligence | Give finance, strategy, and procurement one shared version of the truth |

The bottom line? If you want to run consulting like a strategic category, you need real-time visibility, not after-the-fact reporting. And that’s exactly what digital tools—done right—bring to the table.

Spend Better. Buy Better. Perform Better.

Consulting spend has long flown under the radar—fragmented, under-managed, and often justified by strategic intent rather than measurable outcomes. But that era is ending.

Whether you’re in procurement, finance, or strategy, you now have the tools and frameworks to bring consulting under control—without sacrificing speed or flexibility.

A strong consulting spend analysis doesn’t just reduce cost. It reveals how your organization uses external brainpower—and whether that investment is actually moving the needle.

With a clear taxonomy, structured segmentation, and a tailored supplier panel, you can move from chaos to clarity.

With smart governance and guided sourcing, you can empower the business without letting quality slip.

And with digital tools, you don’t just look in the rearview mirror—you navigate in real time.

Done right, consulting becomes a lever for transformation, not just a line on the P&L.

✅ Ready to Make Consulting a Strategic Category?

Let’s put this into action. At Consulting Quest, we help companies just like yours turn consulting spend into a source of insight, alignment, and competitive advantage.

👉 Book a free consultation call with our team today and start building a category strategy that drives real business value.